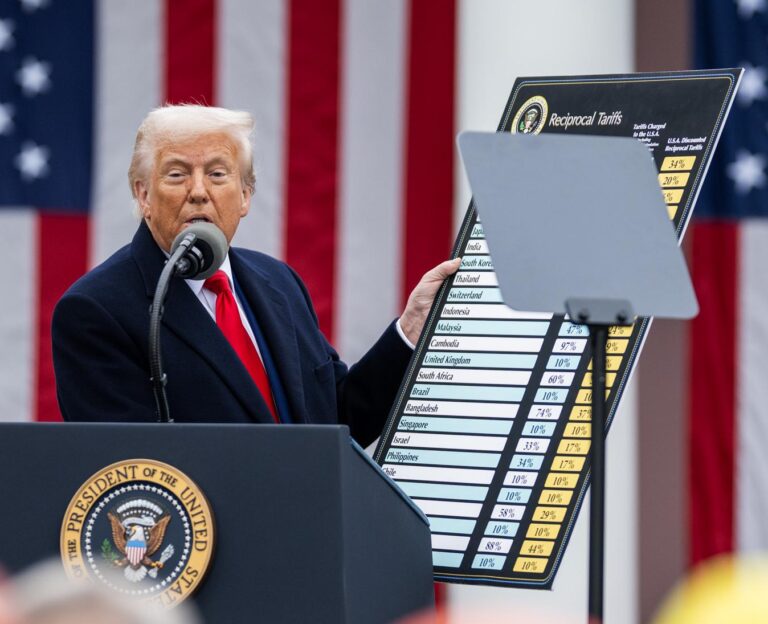

Comprehensive Tariff Reforms Announced at White House “Liberation Day” Event

At a landmark White House event titled “Liberation Day,” former President Donald Trump revealed an ambitious package of tariffs designed to redefine the United States’ trade framework. This initiative signals a renewed commitment to bolstering domestic industries and correcting trade imbalances, with a particular focus on sectors such as steel, technology, and agriculture. The live broadcast on PBS highlighted the administration’s intent to prioritize American economic sovereignty and reduce reliance on foreign imports.

Details of the Newly Introduced Tariff Measures

The tariff strategy includes several key components aimed at shielding U.S. industries from unfair international competition:

- Imposition of tariffs up to 25% on steel and aluminum imports originating from countries outside of allied trade partners.

- Introduction of duties on technology-related imports exceeding $50 billion annually, targeting critical supply chains.

- Sanctions on agricultural imports from nations with subsidized farming sectors, aiming to level the playing field for American farmers.

- Incentive programs encouraging companies to repatriate manufacturing operations to the United States.

| Industry | Tariff Percentage | Expected Outcome |

|---|---|---|

| Steel & Aluminum | 25% | Increase domestic output by approximately 15% |

| Technology Imports | 15%–30% | Stimulate innovation and local R&D investment |

| Agriculture | 10%–20% | Enhance competitiveness for U.S. farmers |

Analyzing the Economic Consequences for Domestic and Global Markets

The implementation of these tariffs marks a decisive pivot toward protectionist trade policies, with far-reaching effects on both the U.S. economy and international commerce. Domestic manufacturers may benefit initially from reduced foreign competition, potentially leading to job growth and revitalized production. However, the risk of retaliatory tariffs from global trading partners could escalate costs for American exporters and destabilize international trade relations.

Several pivotal factors will shape the market’s reaction to these policies:

- Disruptions in global supply chains: Companies may need to reevaluate sourcing strategies as tariffs increase the cost of imported components.

- Rising consumer prices: Tariff-induced cost increases could translate into higher retail prices, impacting household spending power.

- Foreign investment uncertainty: Ambiguity around trade regulations may deter investment in sectors affected by the new tariffs.

| Sector | Potential Domestic Impact | International Reaction |

|---|---|---|

| Automotive | Increased manufacturing expenses | Possible retaliatory tariffs on U.S. vehicles |

| Agriculture | Volatility in export markets | Shift toward alternative suppliers |

| Technology | Risk to R&D funding | Relocation of manufacturing hubs globally |

Industry Feedback and Effects on U.S. Trade Partnerships

Following the tariff announcement, industry leaders and trade experts voiced significant concerns. Representatives from agriculture, manufacturing, and technology sectors warned about the potential for increased operational costs and supply chain interruptions. The American Farm Bureau Federation cautioned that tariffs might undermine U.S. farmers’ export competitiveness, while manufacturers highlighted the risk of escalating production expenses. Many executives advocated for a balanced approach prioritizing collaboration over confrontation to sustain global market stability.

The tariffs are expected to influence U.S. trade relations profoundly, prompting reassessments by key partners. Analysts predict possible retaliatory actions that could strain diplomatic and economic ties. Key anticipated impacts include:

- Intensified trade disputes with major economies such as China and the European Union, potentially leading to prolonged tariff conflicts.

- Disruptions in North American supply chains, particularly affecting automotive and technology industries in Mexico and Canada.

- Inflationary pressures stemming from increased costs of imported goods for American consumers.

- Potential renegotiations of bilateral trade agreements to address tariff-related imbalances.

| Region/Country | Likely Response | Trade Consequences |

|---|---|---|

| China | Implementation of reciprocal tariffs | Disruptions in electronics and manufacturing supply chains |

| European Union | Escalation of trade disputes | Risks to automotive and agricultural exports |

| Mexico & Canada | Calls for NAFTA/USMCA renegotiation | Potential delays and increased costs in cross-border trade |

Effective Business Strategies to Adapt to the New Tariff Environment

To navigate the evolving tariff landscape, companies must implement comprehensive strategies that minimize risk and sustain competitiveness. Diversifying supply chains by sourcing from countries with favorable trade agreements can reduce exposure to tariff-related costs. Additionally, renegotiating supplier contracts to include tariff adjustment clauses can provide greater flexibility in managing price fluctuations and delivery schedules. Utilizing advanced tariff prediction tools and market intelligence will empower businesses to anticipate changes and optimize procurement decisions.

- Utilize free trade zones: Leverage special economic zones to reduce tariff liabilities through value-added processing or re-exporting.

- Increase product localization: Tailor products to meet local market requirements, qualifying for preferential tariff treatments under bilateral agreements.

- Reevaluate pricing models: Assess the feasibility of passing increased costs to consumers without compromising market share.

| Strategy | Benefit | Estimated Implementation Time |

|---|---|---|

| Supply Chain Diversification | Mitigates tariff exposure | 6–12 months |

| Tariff Forecasting Tools | Enhances strategic planning | 3–6 months |

| Local Manufacturing Expansion | Reduces import-related costs | 12–24 months |

Moreover, businesses should actively engage with trade organizations and policymakers to advocate for balanced tariff policies. Transparent communication with stakeholders about tariff risks and mitigation plans is essential to maintain confidence. Companies that combine agility with informed risk management will be better equipped to weather economic uncertainties and seize new market opportunities.

Looking Ahead: Navigating the Future of U.S. Trade Policy

As the administration advances its broad tariff agenda, the economic and geopolitical ramifications will remain under close scrutiny by legislators, industry stakeholders, and international allies. The “Liberation Day” event underscored a persistent focus on safeguarding American economic interests, even as critics warn of potential disruptions to global trade. The evolving responses from markets and foreign governments will serve as crucial indicators of how these policies will influence the international economic order in the coming years.