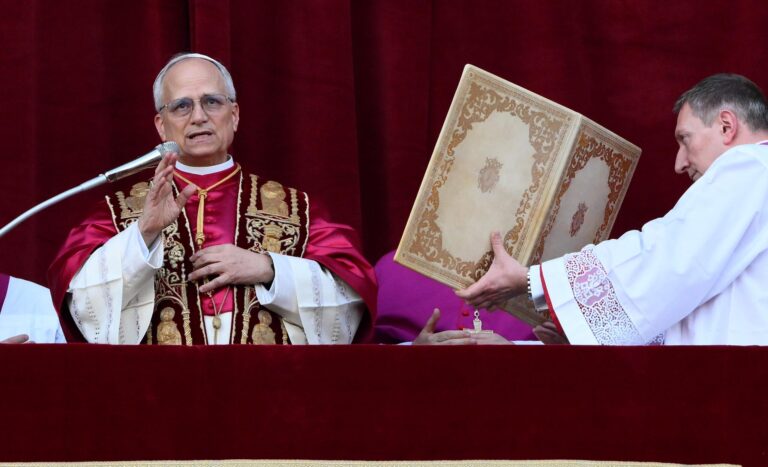

Examining Pope Leo XIV’s Engagement with U.S. Tax Regulations: A Modern Intersection of Faith and Finance

The Intersection of Papal Authority and American Tax Law

Despite his eminent spiritual leadership on the global stage, Pope Leo XIV finds himself confronting the intricate landscape of U.S. tax legislation. This scenario exemplifies how religious prominence does not necessarily exempt one from adhering to the financial laws of foreign jurisdictions. The United States enforces tax rules that can extend to foreign individuals and organizations with financial ties to the country, potentially obligating the pope to submit tax filings or disclose monetary activities. This situation reveals the complex legal challenges that arise when religious leadership intersects with international fiscal regulations.

Key Factors Influencing Tax Responsibilities

- Management of U.S.-based bank accounts or receipt of donations within the country.

- Ownership or investment in real estate located on American territory.

- Income generated through collaborations or charitable initiatives involving U.S. organizations.

| Trigger | Explanation | Consequences |

|---|---|---|

| Donations from U.S. Sources | Contributions from American donors or institutions | May necessitate IRS reporting and adherence to tax laws |

| Property Holdings | Church-owned buildings or residences within the U.S. | Subject to property taxation and possible capital gains tax |

| Investment Assets | Financial instruments held through U.S. brokerage firms | Income may be taxable and require disclosure |

Complexities of International Taxation for Religious Figures

Religious dignitaries, regardless of their global influence, often face the daunting task of navigating international tax systems that do not always recognize ecclesiastical privileges. Pope Leo XIV’s case underscores how U.S. tax authorities can assert jurisdiction over even the highest religious offices when financial activities intersect with American interests. The ambiguity stems from the overlap between religious status, the origin of income, and the nature of funds, placing religious leaders in unprecedented positions where their finances may be subject to governmental examination.

Challenges in Tax Jurisdiction and Compliance

- Dual Taxation Risks: Income earned abroad but connected to U.S.-based entities may trigger multiple tax obligations.

- International Tax Treaties: Agreements between countries can either simplify or complicate tax responsibilities depending on their terms.

- Distinguishing Nonprofit from Personal Income: The blurred boundaries between charitable funds and personal earnings complicate tax declarations.

| Consideration | Effect | Illustration |

|---|---|---|

| Residency Status | Determines filing requirements | Living in Vatican City versus U.S. residency |

| Income Source | Assigns tax jurisdiction | Donations originating from U.S. donors |

| Religious Tax Exemptions | Varies in application and scope | Funds used for charitable purposes versus personal use |

Financial Transparency and Reporting: Implications for the Vatican

Although the papacy traditionally enjoys a revered status that often shields it from many secular legal requirements, Pope Leo XIV’s financial interests within the United States could subject him to American tax and disclosure mandates. The Internal Revenue Service (IRS) requires all individuals and entities with U.S.-sourced income, including foreign nationals, to file annual tax returns. This creates a delicate balance between canonical privileges and federal regulations, compelling the Vatican to carefully manage its financial operations to avoid legal repercussions. Noncompliance could lead to audits, penalties, or diplomatic tensions, potentially affecting the Holy See’s international financial reputation.

Essential Compliance Considerations

- Transparency of Assets: Reporting church-owned properties and investments located in the U.S.

- Income Declaration: Accounting for donations and other revenue generated domestically.

- Precedent Cases: Instances where religious organizations have faced IRS scrutiny for unreported income.

| Compliance Area | Vatican Perspective | U.S. Legal Requirement |

|---|---|---|

| Financial Disclosure | Preserving confidentiality of church finances | Mandatory transparency and reporting to IRS |

| Tax-Exempt Status | Recognition as a sovereign religious entity | Verification and maintenance of nonprofit status |

| Property Ownership | Exemptions for religious use | Filing property tax returns and declarations |

Effective Strategies for Clerical Tax Compliance

Managing tax obligations alongside demanding religious responsibilities requires a methodical and informed approach. Tax laws apply universally, and even prominent clergy such as Pope Leo XIV must ensure compliance if they have financial connections to the U.S. To navigate these complexities, maintaining meticulous financial records is crucial, enabling accurate tracking of income, deductions, and credits throughout the fiscal year.

Recommended Practices for Financial Management

- Adopting secure, specialized digital platforms designed for managing clerical finances.

- Keeping abreast of evolving tax legislation affecting religious and nonprofit organizations.

- Consulting with tax experts experienced in ecclesiastical income and international tax law.

- Conducting periodic financial audits to identify and correct potential filing errors.

| Best Practice | Advantage |

|---|---|

| Detailed Record-Keeping | Minimizes errors in tax filings |

| Professional Guidance | Ensures adherence to complex regulations |

| Technology Utilization | Enhances accuracy and efficiency |

| Ongoing Education | Adapts to changing tax environments |

Conclusion: Navigating the Confluence of Faith and Fiscal Responsibility

The unfolding scrutiny of Pope Leo XIV’s financial affairs within the United States highlights the intricate challenges at the crossroads of religion, international law, and taxation. While the pontiff’s spiritual mission remains central, the practical demands of complying with U.S. tax regulations reflect the evolving realities faced by religious leaders in a globally connected financial landscape. This ongoing situation will attract attention from legal experts, the Vatican, and policymakers, emphasizing the delicate balance between sacred duties and secular financial accountability in the modern era.