Global Investors Reassess Dollar and Treasury Holdings Amid Rising Trade Disputes

In response to intensifying trade frictions sparked by former President Donald TrumpŌĆÖs assertive tariff measures, investors worldwide are increasingly distancing themselves from the U.S. dollar and Treasury securities. The drawn-out trade confrontations have injected considerable unpredictability into international markets, triggering a retreat from assets traditionally deemed safe during turbulent times. This evolving trend underscores mounting apprehensions about the economic repercussions of the trade standoff and hints at amplified market volatility ahead.

Shifting Market Preferences: From the Dollar to Diversified Safe Havens

Investor sentiment has notably shifted as market participants strategically reduce their reliance on the U.S. dollar and government bonds. The persistent ambiguity surrounding trade negotiations has fueled a pivot toward alternative investments perceived as more secure or offering superior returns. This reallocation reflects deepening worries about tariff impacts and retaliatory actions, with capital increasingly flowing into currencies such as the Swiss franc and Japanese yen, alongside commodities and debt from emerging economies.

Primary drivers behind this movement include:

- Escalating tariffs disrupting global trade dynamics and increasing market unpredictability.

- Declining trust in the U.S. administrationŌĆÖs capacity to swiftly resolve trade disputes.

- Heightened inflation expectations reducing the attractiveness of long-duration Treasury bonds.

| Asset Class | Recent Capital Flow | Percentage Change |

|---|---|---|

| U.S. Dollar | Outflow | -4.2% |

| U.S. Treasury Bonds | Outflow | -3.5% |

| Swiss Franc | Inflow | +1.8% |

| Emerging Market Debt | Inflow | +2.4% |

Declining Treasury Yields Mirror Market Unease Amid Trade War Concerns

As fears of a prolonged trade conflict intensify, investors are retreating from traditional safe assets like U.S. Treasurys and the dollar. The ongoing uncertainty surrounding tariff talks has heightened market volatility, leading to a drop in yields across key Treasury maturities as demand for fixed-income securities diminishes. This cautious stance reflects growing anxiety over the potential economic damage wrought by protectionist policies.

Portfolio managers are recalibrating their strategies, favoring alternatives as the threat of disrupted global supply chains looms large. Contributing factors include:

- Heightened volatility: Pronounced fluctuations in currency and bond markets signal investor nervousness.

- Flattening yield curves: Often interpreted as a warning sign of an impending recession amid trade uncertainties.

- Diversification beyond U.S. assets: A flight to safety that extends beyond traditional dollar-denominated instruments.

| Security | Yield Change (bps) | Current Yield |

|---|---|---|

| 2-Year Treasury Note | -5 | 3.12% |

| 10-Year Treasury Note | -7 | 3.45% |

| 30-Year Treasury Bond | -9 | 3.71% |

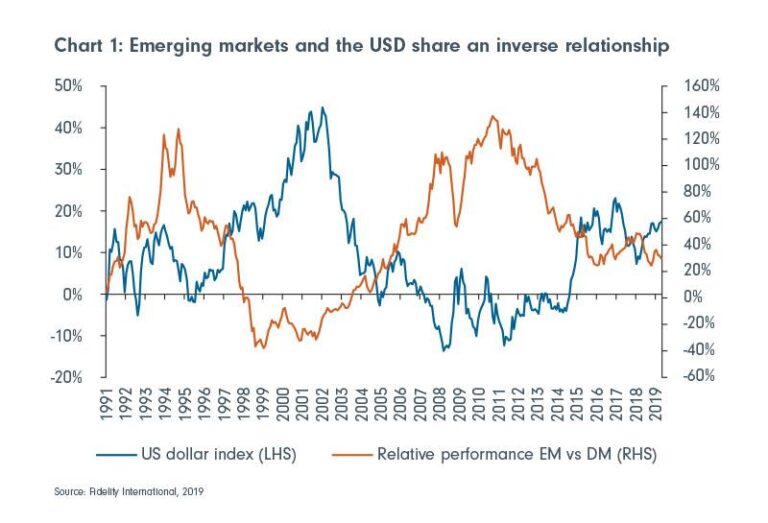

Emerging Markets Rise as Preferred Alternatives Amid U.S. Policy Uncertainty

With uncertainty surrounding U.S. trade policies intensifying, investors are increasingly diverting attention from conventional safe havens like the dollar and Treasury bonds. The escalation of trade tensions during the Trump era has injected volatility into global markets, prompting a strategic pivot toward emerging economies that are viewed as more resilient or offering superior growth potential. Particularly in regions such as Southeast Asia and Latin America, these markets have attracted renewed interest due to their relative insulation from direct U.S. trade conflicts and improving economic fundamentals.

Factors fueling this trend include:

- Efforts to diversify away from dollar exposure amid fears of prolonged trade disruptions.

- Attractive valuations and comparatively higher yields in emerging market equities and bonds.

- Structural reforms enhancing the investment environment in several frontier markets.

- Currency stability supported by proactive central bank policies.

| Country | Current Yield (%) | Trade War Exposure | Investment Potential |

|---|---|---|---|

| Vietnam | 6.3 | Low | High |

| Mexico | 7.0 | Moderate | Moderate |

| Brazil | 8.5 | Low | High |

| India | 7.2 | Low | High |

Investment Strategies to Navigate Volatility in Dollar and Treasury Markets

In light of growing uncertainty surrounding U.S. trade policies, investors are actively adjusting their portfolios to manage heightened volatility in the dollar and Treasury markets. With the U.S. dollar experiencing significant swings, risk-conscious investors are moving away from traditional safe havens, instead embracing diversified currency baskets and alternative fixed-income products to mitigate exposure. Emerging strategies gaining momentum include:

- Boosting allocations to assets denominated in non-U.S. currencies to reduce currency risk.

- Shortening fixed-income durations to adapt to fluctuating Treasury yields.

- Employing derivatives such as options and futures to hedge against abrupt bond price movements.

Investors are also vigilantly tracking geopolitical developments to optimize timing for market entry and exit. Given episodic liquidity in Treasury markets, flexibility and agility are increasingly prioritized over yield maximization. The table below offers a comparative overview of recent yield shifts and volatility across various asset classes:

| Asset | Yield Change (bps) | 30-Day Volatility (%) |

|---|---|---|

| 2-Year Treasury Note | +15 | 1.8% |

| 10-Year Treasury Note | +12 | 1.5% |

| U.S. Dollar Index | -1.2% | 2.7% |

Concluding Perspectives on Investor Behavior Amid Trade Uncertainty

As uncertainty continues to cloud U.S. trade policy, investors remain cautious about holding traditional safe havens such as the dollar and Treasury securities. This hesitancy reflects broader concerns regarding the economic consequences of escalating trade tensions initiated during the Trump administration. Looking ahead, market participants will closely observe policy shifts and their cascading effects on global financial stability, adapting strategies to navigate an increasingly complex investment landscape.