US Moves Forward with Tariff Plans, Raising Global Trade Tensions

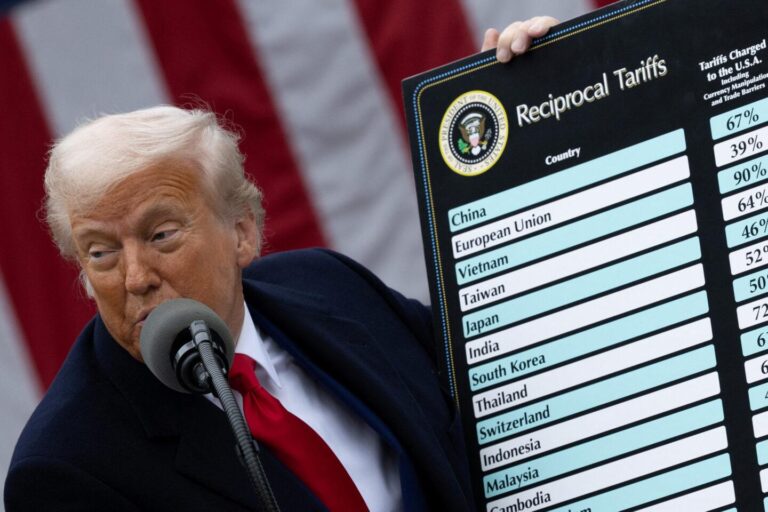

The White House has officially announced that President Donald Trump will advance with the imposition of tariffs, despite widespread international unease about the potential for escalating trade disputes. This decision underscores the administration’s determination to shield American industries and counteract what it deems unfair trade practices by key global partners. Financial markets worldwide have reacted with caution, as investors and governments brace for the possibility of a protracted trade conflict that could disrupt global supply chains and dampen economic growth.

Highlights of the tariff initiative include:

- Coverage: A wide array of imported products from selected countries will be subject to new tariffs.

- Implementation Timeline: The tariffs are scheduled to take effect within the next month, providing a short window for adjustment.

- Goals: To promote equitable trade negotiations and protect American employment in sectors vulnerable to foreign competition.

| Nation | Tariff Percentage | Primary Export Impacted |

|---|---|---|

| China | 25% | Consumer Electronics |

| European Union | 10% | Steel Products |

| Canada | 15% | Automobile Components |

Financial Markets React Sharply to Tariff Announcement

Global financial markets have experienced heightened volatility following the confirmation of new tariffs by the US administration. The announcement has intensified concerns about a sustained trade war between the United States and its major trading partners, triggering rapid sell-offs across stock markets, commodity sectors, and currency exchanges. Investors are recalibrating their risk assessments amid fears of economic disruption.

Notable market responses include:

- Equity Markets: Major indices such as the NASDAQ and Nikkei 225 saw significant declines, wiping out recent gains.

- Currency Movements: The US dollar strengthened as investors sought safe-haven assets, while currencies in emerging economies weakened.

- Commodity Prices: Industrial metals and crude oil prices fell, reflecting concerns over reduced global demand.

| Market | 24-Hour Change | Investor Mood |

|---|---|---|

| Dow Jones Industrial Average | -2.5% | Bearish |

| Shanghai Composite Index | -3.4% | Unsettled |

| EUR/USD Exchange Rate | +0.7% | Volatile |

Anticipated Supply Chain Disruptions and Diplomatic Strains

Analysts warn that the newly imposed tariffs could significantly disrupt global supply chains, which are already under pressure from recent geopolitical challenges. Companies dependent on imported parts may face rising costs, leading to increased consumer prices and potential production delays. Many businesses might be compelled to seek alternative suppliers or relocate manufacturing operations to mitigate tariff-related expenses.

- Immediate Consequences: Price inflation, inventory shortages, and interruptions in supply flow.

- Long-Term Outlook: Potential reshoring of manufacturing, strategic diversification of supply networks, and innovation in cost control.

On the international stage, this tariff escalation risks aggravating relations with key trade partners, notably China and the European Union. Several nations have already hinted at retaliatory tariffs, which could ignite a tit-for-tat trade conflict with extensive economic repercussions. Experts caution that worsening diplomatic ties may also impede cooperation on broader global issues such as security and environmental policies, amplifying uncertainty worldwide.

| Region | Likely Retaliation | Risk Level |

|---|---|---|

| China | Higher tariffs on US exports | Severe |

| European Union | Selective tariffs targeting key sectors | Moderate |

| Mexico and Canada | Increased pressure in trade negotiations | Moderate |

How Businesses Can Adapt to Rising Trade Barriers

In response to the growing threat of tariffs, companies must adopt proactive strategies to reduce vulnerability to geopolitical disruptions. This involves diversifying supply sources, boosting domestic manufacturing capabilities, and forging strategic alliances to absorb cost shocks. Utilizing advanced analytics tools can help businesses anticipate pricing shifts and demand changes, enabling agile operational adjustments.

Effective risk management approaches include:

- Establishing flexible supplier agreements to allow rapid response to changing conditions.

- Building up safety stock for essential materials to prevent production halts.

- Enhancing legal and compliance frameworks to navigate complex trade regulations.

- Implementing financial hedging to protect against currency and commodity price swings.

| Strategy | Advantage |

|---|---|

| Supply Chain Diversification | Minimizes risk of disruption |

| Inventory Reserves | Maintains production flow |

| Regulatory Compliance | Prevents legal issues and trade barriers |

| Financial Hedging | Protects against market volatility |

Looking Ahead: The Future of Global Trade Amid Rising Tariffs

As international markets remain jittery, the White House’s confirmation of tariff enforcement marks a pivotal moment in global trade dynamics. With major economies preparing for possible retaliatory actions, the world watches closely for signs of either escalating conflict or renewed diplomatic engagement. The coming weeks will be decisive in shaping whether these tensions evolve into a full-blown trade war or pave the way for constructive negotiations aimed at stabilizing the global economic landscape.