IrelandŌĆÖs Rise as a Global Corporate Hub Fueled by U.S. Tax Incentives

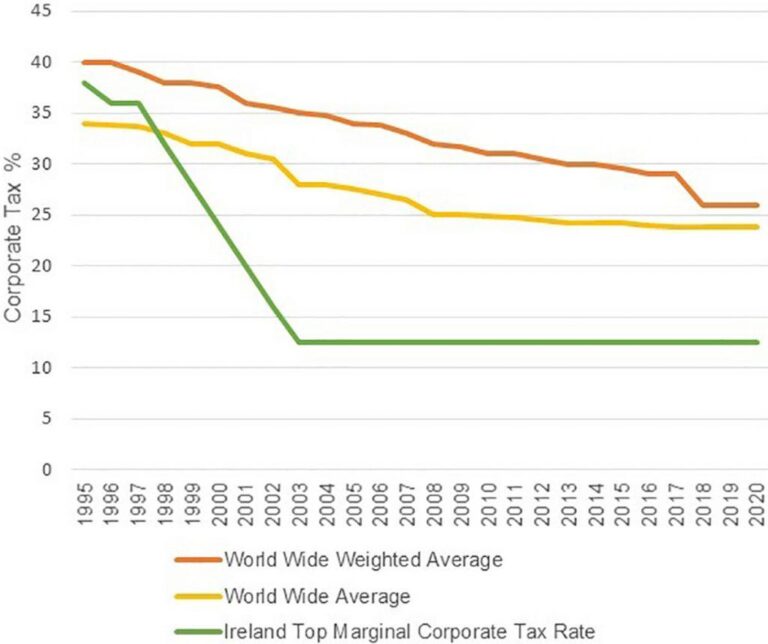

Over the past few decades, Ireland has emerged as a premier destination for multinational corporations, especially those headquartered in the United States. Central to this transformation has been IrelandŌĆÖs competitive corporate tax framework, featuring a notably low 12.5% corporate tax rate alongside specialized incentives. These policies have attracted major players in technology, pharmaceuticals, and finance to establish their European bases in Ireland, resulting in substantial job creation, economic revitalization, and a broadened tax revenue stream that has propelled the nationŌĆÖs modernization efforts.

Nonetheless, this economic model is now confronting significant headwinds due to evolving U.S. tax legislation. The Trump administrationŌĆÖs tax reforms, aimed at curbing profit shifting and instituting a global minimum tax, threaten to diminish IrelandŌĆÖs tax appeal. The table below outlines key tax elements shaping IrelandŌĆÖs economic environment and the potential effects of U.S. policy changes:

| Tax Element | Current Irish Status | Potential U.S. Policy Changes |

|---|---|---|

| Corporate Tax Rate | 12.5% | Possible Increase to 15% |

| Intellectual Property Incentives | Robust Benefits and Tax Planning Opportunities | Stricter Regulations and Limitations |

| Profit Shifting Practices | Widely Employed by Multinationals | Targeted for Curtailment |

How U.S. Tax Reforms Are Reshaping IrelandŌĆÖs Corporate Tax Advantage

The overhaul of the U.S. corporate tax system under the Trump administration has introduced significant challenges for IrelandŌĆÖs economic model, which heavily depends on American multinationals. The Tax Cuts and Jobs Act (TCJA) lowered the U.S. corporate tax rate from 35% to 21% and introduced the Global Intangible Low-Taxed Income (GILTI) tax, designed to discourage profit shifting to low-tax jurisdictions like Ireland. These reforms threaten to erode the tax benefits that have long attracted U.S. tech and pharmaceutical giants to Irish shores.

As a result, Ireland faces a critical juncture with several notable consequences:

- Reduced incentives for profit shifting: U.S. firms may opt to repatriate earnings rather than shelter profits abroad.

- Pressure on IrelandŌĆÖs tax competitiveness: The once-attractive 12.5% rate may lose its edge amid global minimum tax standards.

- Uncertainty in foreign direct investment: Potential investors could hesitate due to diminishing tax advantages.

| Tax Aspect | Before TCJA | After TCJA |

|---|---|---|

| U.S. Corporate Tax Rate | 35% | 21% |

| GILTI Tax | Not Applicable | Tax on Foreign Earnings Introduced |

| Profit Shifting Incentives | High | Significantly Reduced |

Risks Threatening IrelandŌĆÖs Tax Revenue from U.S. Multinationals

IrelandŌĆÖs heavy dependence on U.S. multinational corporations for tax income is increasingly precarious amid global tax reforms and geopolitical shifts. The following challenges highlight the vulnerabilities in IrelandŌĆÖs current economic framework:

- Potential U.S. tax law revisions: Future amendments could further encourage repatriation of profits, reducing taxable income in Ireland.

- International regulatory pressure: Organizations like the OECD are intensifying efforts to combat tax base erosion and profit shifting, which could limit IrelandŌĆÖs tax planning advantages.

- Political volatility in the U.S.: Changes in administration may bring more protectionist or aggressive tax policies, impacting cross-border corporate strategies.

Without broadening its economic base, Ireland risks overexposure to these external shocks. The following table compares tax revenue contributions from U.S. multinationals and other sectors, illustrating the concentration of IrelandŌĆÖs fiscal reliance:

| Revenue Source | 2019 (Ōé¼ Billion) | 2023 (Ōé¼ Billion) | Growth Rate |

|---|---|---|---|

| U.S. Multinational Corporations | 8.7 | 10.1 | +16% |

| Irish Domestic Firms | 2.3 | 2.6 | +13% |

| EU and Other International Entities | 1.5 | 1.7 | +13% |

Adapting IrelandŌĆÖs Economic Strategy to Navigate Global Tax Changes

In response to the shifting international tax environment, Ireland must strategically evolve its economic model to reduce overreliance on U.S. multinationals. While the low corporate tax rate has spurred remarkable growth, diversification is essential to build resilience. Prioritizing sectors such as indigenous innovation, renewable energy, and advanced manufacturing can foster sustainable development less vulnerable to external tax policy fluctuations.

Additionally, Ireland should pursue greater tax policy adaptability to comply with emerging global minimum tax standards while maintaining its attractiveness to investors. Strengthening collaboration with European Union partners on tax harmonization and joint innovation projects will further solidify IrelandŌĆÖs position as a key business hub. Key areas with high diversification potential include:

- Renewable energy and environmental technologies: Expanding offshore wind farms and green tech innovation centers.

- Creative and digital media industries: Capitalizing on DublinŌĆÖs expanding digital ecosystem and creative talent pool.

- Biotechnology and pharmaceutical research: Increasing investment in cutting-edge health sciences and R&D.

- Financial technology and services: Enhancing regulatory frameworks to attract fintech startups and asset management firms.

| Industry Sector | Current Economic Contribution | Diversification Opportunity |

|---|---|---|

| Technology | 40% | Moderate |

| Pharmaceuticals | 25% | High |

| Renewable Energy | 5% | Very High |

| Financial Services | 15% | High |

| Creative Industries | 3% | Moderate |

Looking Ahead: IrelandŌĆÖs Path in a Changing Global Tax Environment

As Ireland confronts the ramifications of evolving international tax policies, particularly those initiated under the Trump administration, its longstanding economic relationship with U.S. multinational corporations faces uncertainty. Potential adjustments in corporate tax rates and enforcement mechanisms could significantly alter IrelandŌĆÖs role as a favored tax jurisdiction. Navigating this complex landscape will require strategic agility, economic diversification, and enhanced international cooperation to sustain IrelandŌĆÖs growth and fiscal stability in the years ahead.