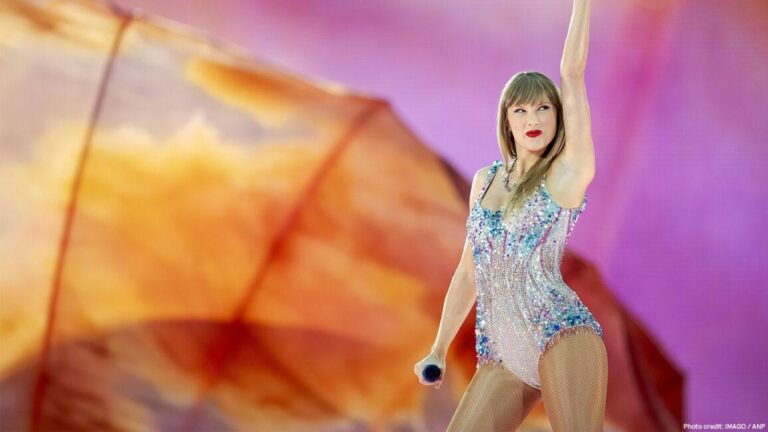

The Economy Reimagined: A Contemporary Perspective Inspired by Taylor SwiftŌĆÖs Reinvention

In a creative blend of cultural influence and economic insight, The Washington PostŌĆÖs feature, ŌĆ£The Economy (TaylorŌĆÖs Version),ŌĆØ reinterprets the current U.S. economic landscape through a lens inspired by Taylor SwiftŌĆÖs celebrated artistic revival. This article offers a compelling synthesis of detailed economic analysis and relatable commentary, aiming to connect with a diverse readership by drawing parallels between SwiftŌĆÖs reinvention and the evolving nature of economic policies and market performance.

Unpacking the Economic Resurgence: A Fresh Take on Growth and Stability

Recent data reveals a vigorous economic rebound, driven by a combination of targeted fiscal strategies and a resilient labor force. Consumer expenditure has surged, fueled by growing optimism about market conditions and increased disposable income levels. Notably, sectors such as information technology and advanced manufacturing have experienced significant expansion, indicating a broad-based recovery rather than isolated sectoral gains. This upswing is further supported by heightened investments in infrastructure projects and renewable energy initiatives, positioning the economy for sustainable long-term growth.

Despite these positive trends, persistent hurdles remain, including inflationary challenges and ongoing supply chain disruptions. Policymakers are tasked with the complex balancing act of maintaining economic stimulus while curbing inflation to prevent overheating. The table below highlights key economic indicators that illustrate this delicate equilibrium:

| Indicator | Q1 2023 | Q1 2024 | Change |

|---|---|---|---|

| GDP Growth Rate | 2.1% | 3.4% | +1.3% |

| Consumer Spending | $1.8 Trillion | $2.1 Trillion | +16.7% |

| Inflation Rate | 4.2% | 3.9% | -0.3% |

| Unemployment Rate | 5.5% | 4.1% | -1.4% |

- Robust labor market conditions enhancing consumer optimism

- Policy emphasis on infrastructure and eco-friendly energy solutions

- Ongoing but easing inflationary pressures

- Supply chain improvements bolstering economic resilience

Market Dynamics Shaped by Economic Forces: Trends and Sectoral Impacts

The evolving economic environment has triggered significant shifts across various market sectors. Key indicators such as consumer confidence, employment statistics, and inflation rates collectively influence investor behavior and spending patterns. For example, rising inflation often compels companies to revise pricing, affecting profit margins and stock market valuations. Industries like retail and manufacturing are particularly vulnerable to changes in consumer purchasing power, making economic health a critical factor in their strategic planning.

The table below summarizes how recent economic indicators have influenced different market segments over the past quarter:

| Economic Indicator | Market Impact | Affected Sectors |

|---|---|---|

| Inflation Increase | Rising operational costs | Retail, Manufacturing |

| Declining Unemployment | Boost in consumer expenditure | Services, Real Estate |

| Interest Rate Hikes | Higher borrowing expenses | Financial Services, Construction |

Industry experts highlight adaptability as a vital strategy for navigating these economic fluctuations. Businesses are increasingly adopting technological innovations and diversifying supply chains to mitigate risks associated with market volatility. Investors, meanwhile, are gravitating towards companies with strong financial health and transparent governance, which tend to withstand economic uncertainties better. In this context, thorough analysis of economic signals is essential for making well-informed investment and operational decisions.

- Shifts in consumer behavior influenced by wage growth and employment trends

- Supply chain challenges remain a concern amid variable demand and raw material costs

- Central bank monetary policies continue to shape lending conditions and capital availability

Charting a Path for Sustainable Economic Growth: Lessons from TaylorŌĆÖs Version

To cultivate an economy as dynamic and innovative as Taylor SwiftŌĆÖs reimagined catalog, policymakers should focus on advancing green technology investments and sustainable infrastructure development. Prioritizing these areas not only reduces environmental footprints but also establishes a resilient economic base capable of withstanding future disruptions. Transitioning to renewable energy projects, expanding electric transportation systems, and embracing circular economy principles will empower both communities and industries, fostering long-term fiscal and ecological balance.

Additionally, modern labor policies that accommodate todayŌĆÖs diverse workforceŌĆösuch as flexible scheduling, comprehensive retraining initiatives, and fair wage frameworksŌĆöare crucial for inclusive economic progress. These approaches help align rapid technological changes with workforce capabilities, mitigating unemployment and underemployment risks. The following table contrasts traditional economic models with a forward-thinking, Taylor-inspired framework:

| Policy Area | Conventional Approach | Innovative Taylor-Inspired Model |

|---|---|---|

| Energy | Dependence on Fossil Fuels | Investment in Renewables |

| Workforce | Fixed 9-to-5 Employment | Flexible and Remote Work Options |

| Growth Metrics | GDP-Focused | Emphasis on Equity and Sustainability |

- Promote collaborations between public and private sectors to drive sustainable innovation

- Offer incentives for small and medium enterprises adopting eco-friendly practices

- Strengthen social safety nets to support workforce transitions amid economic shifts

Investment Approaches Amid Economic Renewal: Balancing Risk and Opportunity

With renewed market optimism, investors are recalibrating portfolios to optimize returns while managing risks. There is a noticeable shift towards cyclical industries that typically benefit from economic recoveries. Sectors such as technology, consumer discretionary, and industrials are attracting increased capital as fund managers seek to leverage pent-up demand. Concurrently, a growing segment of investors is channeling funds into sustainable enterprises, aligning financial goals with environmental and social responsibility.

Risk mitigation remains a priority, encouraging diversified investment strategies across asset classes. Key approaches gaining popularity include:

- Value stock rotation: Targeting undervalued companies with solid fundamentals

- Incremental bond acquisitions: Providing a buffer against market volatility

- Alternative assets: Including real estate and commodities as inflation hedges

- Maintaining liquidity: Holding cash reserves to exploit market corrections swiftly

| Investment Strategy | Anticipated Advantage | Typical Portfolio Allocation |

|---|---|---|

| Value Stocks | Growth potential during recovery phases | 30% |

| Corporate Bonds | Income stability and risk mitigation | 20% |

| Alternative Investments | Diversification and inflation protection | 15% |

| Cash Reserves | Liquidity for opportunistic investments | 10% |

Looking Ahead: Navigating the Future of the American Economy

Revisiting ŌĆ£The Economy (TaylorŌĆÖs Version)ŌĆØ provides a nuanced and contemporary examination of the United StatesŌĆÖ financial landscape. As the nation adapts to shifting economic realities, this analysis highlights the importance of integrating historical insights with current data to guide effective policy-making. By fostering dialogue around sustainable growth, equitable labor practices, and strategic investment, the article encourages a forward-thinking approach to securing the countryŌĆÖs economic prosperity.