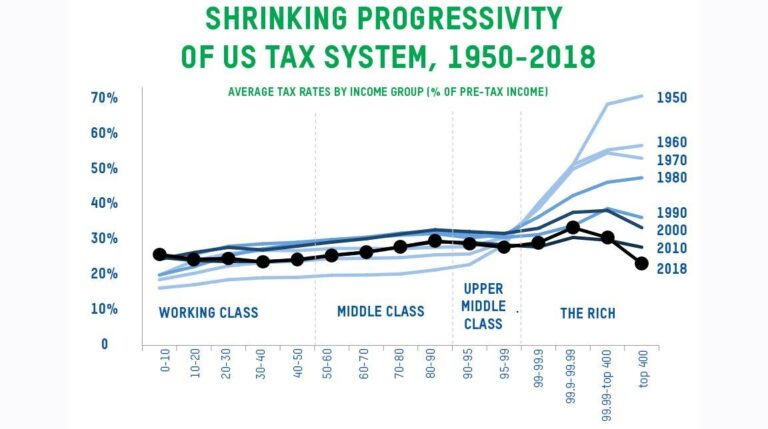

For the first time in American history, U.S. billionaires paid a lower effective tax rate than the working class in the previous year, according to a groundbreaking report by The Washington Post. This unprecedented discrepancy highlights glaring inequalities within the nation’s tax system, sparking debate over fairness and the growing influence of wealth on fiscal policy. As policymakers and the public grapple with these revelations, questions of tax reform and economic justice have taken center stage in the national conversation.

Billionaires Outpace Workers in Tax Rate Disparity Spotlight on Wealth Inequality and Tax Policy Loopholes Urgent Calls for Tax Reform to Ensure Fair Contributions from the Ultra-Rich Exploring Solutions to Restore Equity in the U.S. Tax System

In a stark revelation that has sent shockwaves through economic and political circles, data shows that U.S. billionaires paid an effective tax rate lower than that of the average working class for the first time ever. This discrepancy highlights a critical imbalance in the tax landscape, fueled by complex loopholes and preferential tax treatment on capital gains, dividends, and estate transfers. While workers face federal income tax rates ranging from 10% to 37%, the ultra-rich have leveraged sophisticated tax strategies to reduce their tax burden to rates sometimes below 20%, exacerbating the wealth gap and undermining public trust in the fairness of the tax system.

The consequences of this disparity are far-reaching, sparking urgent debates on tax reforms aimed at leveling the playing field. Proposed solutions include:

- Implementing a minimum tax rate on billionaires’ wealth to ensure they contribute proportionally to their economic influence

- Closing loopholes that allow capital gains and dividends to be taxed at lower rates than ordinary income

- Enhancing transparency and enforcement to prevent tax avoidance schemes

- Revising estate taxes to limit generational wealth transfers without significant taxation

| Taxpayer Group | Average Tax Rate Paid | Primary Tax Advantages |

|---|---|---|

| U.S. Billionaires | 18.5% | Capital gains, dividends, estate tax loopholes |

| Middle-Class Workers | 22.4% | Federal income tax, payroll taxes |

| Low-Income Workers | 15.7% | Payroll taxes, limited deductions |

Addressing these inequalities is essential not only for revenue but for restoring confidence in a system perceived as disproportionately skewed in favor of the wealthy. Policymakers, activists, and economists are coalescing around the notion that substantial reform is overdue to ensure that economic prosperity translates into equitable contributions, fostering a resilient and just fiscal future.

In Conclusion

As the nation grapples with growing economic inequality, last year’s unprecedented tax data underscores a critical void in the tax system’s fairness and effectiveness. The revelation that U.S. billionaires paid a lower tax rate than the working class for the first time in history raises urgent questions about the structure and enforcement of tax policies. Policymakers, economists, and citizens alike face mounting pressure to address these disparities to ensure a more equitable distribution of the tax burden in the years ahead.