Expanded U.S. Tariffs on Global Exports: Analyzing the Economic and Diplomatic Fallout

Comprehensive Overview of the U.S. Tariff Expansion

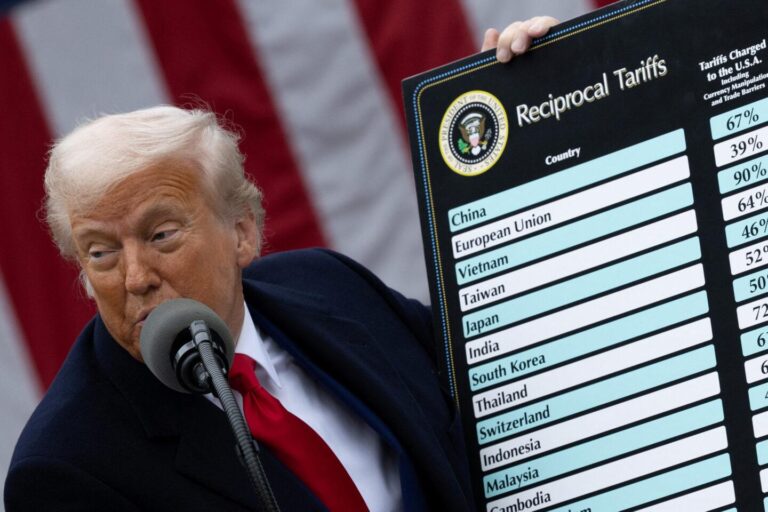

In a decisive policy shift with far-reaching consequences for international commerce, the former U.S. administration under Donald Trump has introduced a broad set of tariffs targeting imports from a diverse group of nations. This initiative, designed to strengthen American manufacturing and address perceived trade imbalances, encompasses a wide array of goods such as consumer electronics, textiles, and agricultural commodities. The move reflects a more assertive protectionist approach amid ongoing disputes over trade fairness, intellectual property rights, and market accessibility.

The tariff adjustments affect key global players including:

- China

- Germany

- Mexico

- South Korea

- Brazil

| Nation | Major Export Impacted | Tariff Increase (%) |

|---|---|---|

| China | Consumer Electronics | 15% |

| Germany | Automotive Components | 10% |

| Mexico | Farm Produce | 12% |

Industry analysts caution that while these tariffs may temporarily shield certain U.S. sectors, they risk triggering retaliatory tariffs and escalating production expenses. Economists warn that prolonged trade conflicts could stifle global economic momentum and disrupt critical supply chains, especially in technology and manufacturing sectors.

Global Economic Ramifications and U.S. Market Stability

The newly enacted tariffs are poised to alter global trade flows and challenge the stability of the U.S. economy. By increasing the cost of imported goods, these measures may provoke retaliatory actions from affected countries, potentially fracturing established supply networks. Industries heavily dependent on international inputs—such as automotive manufacturing, electronics production, and agriculture—could face rising costs, which may translate into higher consumer prices and diminished export competitiveness.

From an economic perspective, the uncertainty generated by these tariffs could suppress investment and slow growth. Key areas to watch include:

- Supply Chain Disruptions: Firms might relocate production or diversify suppliers to circumvent tariff impacts, reshaping global manufacturing hubs.

- Market Volatility: Financial markets may experience fluctuations as companies revise earnings forecasts amid trade uncertainties.

- Consumer Behavior: Increased prices on imports could reduce disposable income, affecting retail and service sectors domestically.

| Industry | Projected Impact | Likely Corporate Response |

|---|---|---|

| Automotive | Production costs rise by 10-15% | Shift towards local suppliers, adjust pricing |

| Electronics | Delays in supply chains, increased component costs | Supplier diversification, build inventory buffers |

| Agriculture | Decline in export demand, price instability | Explore alternative markets, advocate for tariff exemptions |

International Responses and Rising Diplomatic Strains

Governments worldwide have promptly condemned the tariff expansions, warning of their detrimental effects on fragile economic recoveries post-pandemic. The European Union has voiced particular apprehension, highlighting the threat of a full-scale trade war that could destabilize global markets. Asian nations such as China, South Korea, and Japan have signaled intentions to retaliate, foreshadowing heightened diplomatic tensions. The broad scope of tariffs—spanning steel, electronics, and agricultural exports—has intensified calls for urgent negotiations to prevent prolonged economic discord.

Primary concerns from affected countries include:

- Disruptions to global supply chains and increased manufacturing costs.

- Escalation of retaliatory tariffs potentially leading to trade wars.

- Job losses in sectors reliant on exports.

- Undermining of multinational trade agreements and alliances.

| Region/Country | Key Export Affected | Official Reaction |

|---|---|---|

| European Union | Automobiles & Industrial Machinery | Requested WTO dispute consultations and sanctions relief |

| China | Electronics & Apparel | Announced reciprocal tariffs on U.S. agricultural products |

| Canada | Lumber & Energy Resources | Called for urgent bilateral negotiations |

| South Korea | Semiconductors | Raised concerns in international trade forums |

Practical Strategies for Businesses Amid Tariff Challenges

Companies impacted by the expanded tariffs must adapt swiftly to sustain their market positions. A critical strategy involves diversifying supply chains by sourcing from regions less affected by the new duties, thereby mitigating cost pressures and reducing reliance on vulnerable markets. Additionally, revisiting pricing models can help absorb tariff-related expenses without alienating customers. Investing in automation and process improvements can further offset increased production costs.

Beyond operational changes, engaging in trade advocacy is essential. Businesses should collaborate with industry groups and policymakers to seek exemptions or relief where feasible. Maintaining open communication channels with suppliers and distributors enhances negotiation leverage and fosters resilience in the evolving trade environment. The following table outlines key actions and their benefits:

| Recommended Action | Expected Advantage |

|---|---|

| Expand supplier base | Minimizes exposure to tariffs |

| Adjust pricing strategies | Preserves profit margins |

| Invest in operational efficiency | Reduces overall production costs |

| Participate in trade lobbying | Increases chances of tariff relief |

| Enhance supplier communication | Strengthens negotiation positions |

Final Thoughts

As these tariffs come into force, their full impact on global commerce and diplomatic relations remains uncertain. Observers will be watching closely to see how affected nations respond and whether these measures prompt significant shifts in supply chains or intensify trade conflicts. This evolving scenario highlights the intricate balance policymakers must strike between protecting domestic industries and fostering international economic cooperation in an interconnected world.