Washington, D.C.’s Hospitality Industry Faces Headwinds Amid Policy-Driven Tourism Decline

Shifts in Visitor Trends Challenge D.C.’s Hospitality Landscape

The hospitality sector in Washington, D.C. is currently confronting significant challenges as recent federal policy changes have contributed to a downturn in both leisure and business travel. Hotels, dining establishments, and event spaces across the capital report a marked reduction in guest arrivals, largely attributed to tightened immigration regulations, a decrease in government-related conferences, and a politically charged environment that discourages some international visitors. These factors have compelled local businesses to rethink operational strategies, including workforce management and promotional efforts, to sustain profitability amid intensifying competition.

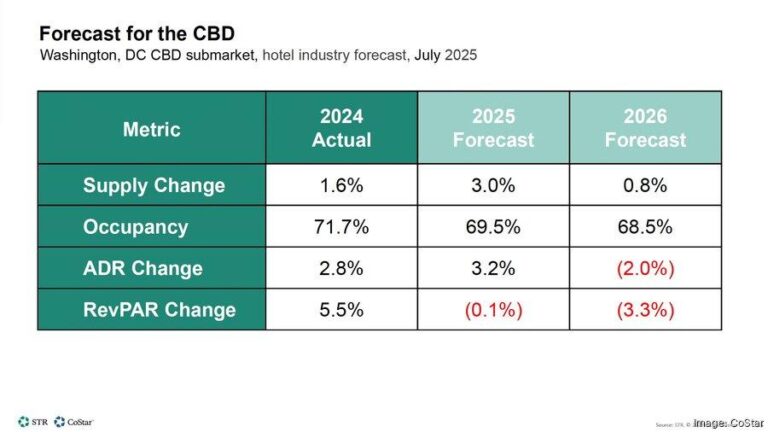

Comparing recent data with figures from previous years reveals the extent of the impact on the hospitality industry’s core metrics:

| Indicator | 2019 | 2023 |

|---|---|---|

| Hotel Occupancy Rate | 78% | 64% |

| Average Daily Rate (ADR) | $210 | $185 |

| Convention Bookings | 3,450 | 2,100 |

- Decline in international visitors linked to stricter visa policies

- Reduction in federal and political events leading to fewer large gatherings

- Escalating operational expenses amid a tightening labor market

Economic Consequences for Local Enterprises and Workforce

The downturn in tourism has triggered a cascade of economic challenges for D.C.‚Äôs local businesses. Many well-known eateries, boutique hotels, and souvenir retailers have witnessed a sharp drop in customer traffic, with some forced to reduce their operations or close entirely. Employment within the hospitality sector has been particularly hard hit, with hourly and seasonal workers‚ÄĒwho rely heavily on tourist influxes‚ÄĒexperiencing significant job losses. This contraction not only diminishes direct spending but also disrupts the broader ecosystem supporting transportation, entertainment, and event management services.

Experts caution that without proactive measures, the sector’s decline could deepen, exacerbating unemployment and economic instability. The following breakdown highlights the most affected segments:

- Lodging: Occupancy rates have dropped by approximately 25%, leading to widespread workforce reductions.

- Food and Beverage: Revenues have fallen nearly 30%, especially in areas heavily reliant on tourists.

- Retail and Souvenir Shops: Sales have decreased significantly due to diminished visitor spending.

| Sector | Revenue Decline | Employment Reduction |

|---|---|---|

| Hotels & Lodging | ‚ąí25% | ‚ąí15% |

| Restaurants & Bars | ‚ąí30% | ‚ąí20% |

| Retail & Souvenirs | ‚ąí18% | ‚ąí10% |

How Immigration and Security Policies Are Shaping Visitor Behavior

Heightened immigration scrutiny and reinforced security protocols have played a pivotal role in deterring visitors to Washington, D.C. International travelers now face longer processing times at airports, more rigorous documentation requirements, and an overall perception of an unwelcoming environment. These deterrents are especially pronounced among visitors from countries affected by travel bans or visa restrictions, directly impacting the hospitality sector’s reliance on a diverse global clientele.

Industry specialists identify several key factors contributing to this decline:

- Prolonged visa application procedures discouraging both business and leisure travelers

- Intensified airport security checks leading to delays and traveler frustration

- Adverse international reputation fueled by contentious policy debates and media narratives

| Policy Measure | Visitor Number Impact | Effect on Hospitality |

|---|---|---|

| Visa Processing Delays | ‚ąí15% | Increase in booking cancellations |

| Stricter Security Screenings | ‚ąí10% | Higher customer dissatisfaction |

| Travel Restrictions | ‚ąí20% | Drop in international event participation |

Pathways to Revive Washington, D.C.’s Hospitality Sector

To reverse the downward trend in tourism caused by recent federal policies, stakeholders in D.C.‚Äôs hospitality industry must embrace coordinated strategies aimed at rebuilding trust and broadening the city‚Äôs appeal. Amplifying marketing efforts that highlight the capital‚Äôs rich cultural heritage, vibrant arts scene, and historic landmarks can rekindle interest among potential visitors. Moreover, forging alliances between local enterprises and global travel agencies can open doors to new markets. Embracing technological advancements‚ÄĒsuch as immersive virtual experiences and streamlined online booking platforms‚ÄĒwill be essential to meet the expectations of today‚Äôs travelers.

Recommended strategic actions include:

- Implementing promotional campaigns targeting off-peak travel periods

- Launching eco-friendly tourism initiatives to attract environmentally conscious visitors

- Lobbying for visa policy reforms to simplify international travel

- Enhancing community involvement to enrich visitor experiences

| Initiative | Expected Outcome | Implementation Timeline |

|---|---|---|

| Joint Marketing Efforts | Boost visitor numbers by 15% | 6‚Äď12 months |

| Visa Policy Advocacy | Increase international arrivals | 12‚Äď18 months |

| Sustainable Tourism Development | Enhance city’s eco-friendly reputation | Ongoing |

| Investment in Digital Tools | Improve customer engagement and bookings | 3‚Äď6 months |

Looking Ahead: Navigating Recovery in D.C.’s Hospitality Market

As Washington, D.C.’s hospitality industry contends with the lingering effects of policy-driven declines in visitor numbers, the path to recovery hinges on adaptive strategies, innovative marketing, and favorable political developments. Balancing the city’s identity as a political epicenter with its aspirations as a top-tier travel destination will be crucial. The upcoming months will serve as a pivotal period to determine whether the sector can regain its former vitality and overcome the challenges imposed by recent regulatory changes.