The longest government shutdown in U.S. history has finally wrapped up after 35 tense days, ending a political showdown that halted key federal operations, sidelined hundreds of thousands of workers, and sent shockwaves through the broader economy. As agencies reopen and employees clock back in, the consequences-both political and practical-are still unfolding. From stalled paychecks and delayed public services to unfinished policy battles over border security, the shutdown’s effects will linger long after Washington’s lights are fully back on.

Below is a comprehensive breakdown of how the shutdown unfolded, who took the hardest hit, what’s coming back online, and how households and businesses can prepare for the next funding fight.

How the shutdown began and why it lasted so long

The crisis started with a familiar Washington scenario: a missed funding deadline and a bitter dispute over money for a border wall. What many initially saw as a short-term standoff quickly escalated into an unprecedented, 35-day shutdown that stretched across the holiday season and into the new year.

As Congress failed to pass a full-year spending package in December, departments that rely on annual appropriations began to scale back:

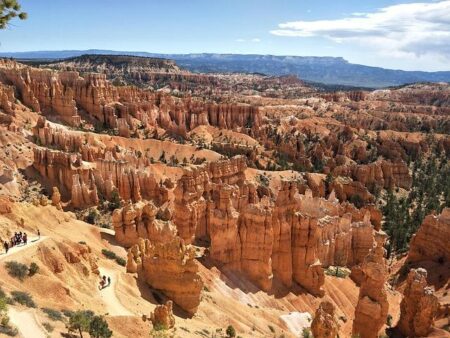

- National parks slashed staffing and stopped many routine services.

- Routine food safety inspections were postponed or slowed.

- Hundreds of thousands of federal employees were told either not to report to work (furloughed) or to work without pay (excepted employees).

Paydays came and went without deposits, turning what is usually a quiet administrative process into a national flashpoint. Political leaders dug in publicly-through televised addresses, on-the-record briefings, and rapid-fire exchanges on social media-turning a traditional budget conflict into a test of endurance and political will.

Over time, several factors pushed negotiators toward a resolution:

- Escalating economic alarms: Federal contractors, small businesses, and even some state and local governments began reporting mounting financial losses. The Congressional Budget Office later estimated that the 35-day shutdown cut billions from U.S. GDP, with some of that output permanently lost.

- Obvious strain on core services: Longer lines at security checkpoints, concerns over air traffic control staffing, and court delays turned abstract politics into tangible inconvenience and risk.

- Organized pressure from unions and advocacy groups: Federal employee unions, nonprofit organizations, and advocacy coalitions amplified worker stories and organized protests, increasing public awareness and political risk.

- Growing bipartisan frustration: As the stalemate dragged on, lawmakers from both parties-especially those in competitive districts-signaled fatigue with brinkmanship and urged a way out.

Ultimately, leaders agreed to a short-term continuing resolution (CR) that temporarily restored funding for affected agencies without immediately resolving the deeper border security dispute. This stopgap measure reopened the government and allowed unpaid workers to receive back pay, even as the core policy disagreements moved to a separate negotiating track.

| Phase of Shutdown | Defining Characteristics |

|---|---|

| Initial Phase | Funding lapses, agencies scale back, political positions harden over border wall money. |

| Escalation Period | Federal workers miss first and second paychecks; public disruptions and media scrutiny intensify. |

| Resolution Period | Economic warnings spike, bipartisan pressure grows, and leaders accept a stopgap deal to reopen agencies. |

The human and economic toll of the record shutdown

For hundreds of thousands of public servants, the shutdown wasn’t an abstract policy battle-it was a personal financial crisis. Many federal employees, along with a large workforce of contractors who often do not receive back pay, abruptly became experts in budgeting, forbearance programs, and emergency assistance.

Workers responded in ways that underscored how many households live close to the financial edge:

- Draining savings accounts and retirement contributions.

- Increasing credit card debt, personal loans, or borrowing from friends and family.

- Visiting food banks and community relief centers for the first time.

- Negotiating with landlords, mortgage companies, and utility providers to avoid penalties or eviction.

The stress was especially severe among lower-wage federal employees-such as custodial staff, administrative support roles, and some early-career professionals-who had little or no emergency savings and faced impossible tradeoffs between essentials like housing, medication, childcare, and transportation.

Local economies tethered to federal offices also took a direct hit. Businesses built around stable government foot traffic-coffee shops near federal buildings, daycare centers serving government families, dry cleaners, and rideshare drivers-saw revenues plunge almost overnight. In cities like Washington, D.C., and regions with heavy federal presence or major installations, this drop in daily spending highlighted how many small enterprises depend on consistent federal paychecks.

Economists have emphasized that the damage doesn’t vanish simply because agencies reopen. Lost output from stalled contracts, paused scientific research, and delayed regulatory decisions can’t always be made up later. For example:

- Research and development projects funded with federal grants often run on strict timelines; interruptions can cause data gaps, missed seasons of fieldwork, or lost momentum in labs.

- Infrastructure and construction contracts that paused midstream can face cost overruns and renegotiations, slowing down broader economic activity.

- Tourism-driven communities near national parks and monuments absorb lost revenue from canceled trips and reduced visitor spending, with some seasonal businesses unable to recover fully.

Some of the most visible shutdown effects included:

- Disrupted household finances: Federal workers postponed rent and mortgage payments, delayed car repairs, adjusted grocery budgets, and turned to community-based relief as a stopgap.

- Local revenue shocks: Cities and counties with a large federal workforce saw consumer spending fall, which can reduce sales tax receipts and strain local budgets.

- Interrupted oversight and services: Slower inspections for food, transportation, and workplaces, as well as delays in permits and reviews that the private sector depends on for long-term planning.

| Group / Sector | Immediate Consequences | Ongoing or Long-Term Effects |

|---|---|---|

| Federal Employees | Missed paychecks, forced unpaid work, financial hardship. | Higher debt loads, depleted savings, longer recovery time for household budgets. |

| Federal Contractors | Work stoppages, layoffs or reduced hours, uncertain compensation. | Permanent loss of income for many; potential contract changes, reduced staffing. |

| Local Businesses | Sharp drop in customers, reduced daily sales, inventory adjustments. | Delayed expansion plans, tighter margins, more cautious hiring. |

| National Economy | Lower quarterly growth, delayed investments and spending. | Reduced confidence in federal reliability, increased perception of political risk. |

Which federal services are returning-and when relief will be felt

As the shutdown ends, federal agencies aren’t flipping back on all at once. Instead, they’re restoring operations in stages, prioritizing essential functions and the most visible points of public contact.

Key areas coming back online include:

Air travel and transportation

- Transportation Security Administration (TSA) officers and air traffic controllers who worked without pay are now receiving back wages, and furloughed colleagues are returning to duty.

- Travelers should see gradual improvement in checkpoint wait times within days, but full normalization of schedules and staffing may take one to two weeks as rosters are rebalanced and backlogs clear.

- Federal Aviation Administration (FAA) functions related to safety and certification, which slowed during the shutdown, are resuming, but licensing and review delays may persist for a short period.

Tax filing, refunds, and the IRS

- At the Internal Revenue Service (IRS), staff are reopening call centers, processing paper returns, and working through a pileup of correspondence.

- With millions of taxpayers filing early each year, the agency faces the dual challenge of catching up from the shutdown while also handling peak filing season.

- Basic processing has restarted, but customer service wait times and response delays may linger for several weeks as systems and staffing ramp back to full strength.

National parks and public lands

- National Park Service sites are unlocking gates and restoring access to trails, visitor centers, and recreation areas.

- However, restoring everything to pre-shutdown levels-guided tours, ranger-led programs, cultural events, maintenance projects, and full-scale trash and restroom services-will take time as staff assess conditions and address any damage or safety hazards that developed during the closure.

- Gateway communities that depend on park tourism may see visitor numbers rebound, but lost holiday-season traffic is unlikely to be fully recovered.

Food, housing, and safety net programs

- Agencies overseeing key benefits such as food assistance and housing aid are prioritizing payments to minimize disruption for vulnerable households.

- State and local administrators are working through application and renewal backlogs, and some processing slowdowns may continue temporarily.

- Safety inspections and regulatory oversight in areas such as food production, transportation, and workplace safety are being restored, though full capacity will return gradually.

A snapshot of what Americans can expect:

- Air travel: Noticeable improvement in security wait times within a few days, with broader schedule reliability returning over 1-2 weeks.

- Tax services: Filing and refund processing have resumed, but callers should anticipate extended hold times and slower responses for several weeks.

- Parks and public lands: Basic access is returning first, followed by more comprehensive services, repairs, and programs over the coming weeks.

- Food and housing benefits: Core payments are being prioritized, but case processing and local appointments may temporarily run behind schedule.

| Service Area | Current Status | Estimated Timeline for Normalization |

|---|---|---|

| Airport Security | Staff returning to regular shifts, overtime balancing underway. | From a few days up to about one week for most major airports. |

| Tax Filing & Refunds | Backlog clearing in progress; full operations resuming. | Several weeks before customer service and processing times stabilize. |

| National Parks | Reopening with limited services and gradual restoration of full operations. | Multiple weeks for all programs and maintenance to return to normal. |

| Federal Benefits | Payments prioritized; essential disbursements moving quickly. | Mostly immediate for payments; administrative catch-up over the next few weeks. |

Looking ahead: the next funding fight and how to prepare

Although the government has reopened, the underlying budget and policy disputes that triggered this record shutdown remain only partially resolved. Future deadlines-and the possibility of another funding lapse-are very real.

To understand where things might head next, pay attention to a few warning signs in Washington:

- Signals in budget and oversight hearings: Committee hearings often reveal where agencies are feeling strain and which programs could become bargaining chips in negotiations.

- Policy riders attached to spending bills: Appropriations packages can become vehicles for unrelated fights over issues like border security, healthcare policy, or environmental regulations. These add-ons can stall or derail otherwise routine funding.

- Short-term continuing resolutions (CRs): Repeated use of brief stopgap measures keeps agencies on edge and increases the risk of another shutdown every few weeks or months.

- Agency-by-agency deals: Funding some departments while leaving others temporarily exposed can create uneven vulnerabilities and deepen operational uncertainty.

- Debt-ceiling debates folded into budget talks: When the debt ceiling and spending bills collide, the stakes climb sharply for financial markets, public benefits, and the broader economy.

- Public statements from federal unions and inspectors general: These often highlight operational risks or safety issues before they dominate national headlines.

For individuals, families, and businesses that depend-directly or indirectly-on federal dollars or federal services, advance planning is increasingly important.

How households can protect themselves before the next shutdown

If you’re a federal employee, contractor, or someone who relies on government benefits, it’s worth building your own contingency plan:

- Create a dedicated emergency fund: Aim to save enough to cover at least one full pay cycle-ideally more-specifically earmarked for potential lapses in pay or benefits.

- Prioritize essential expenses: Make a list of critical bills, such as rent or mortgage, utilities, insurance, transportation, and medication. This helps you act quickly if your income is disrupted.

- Talk proactively with creditors and landlords: Many lenders, banks, and landlords now have hardship or forbearance policies explicitly designed for shutdown periods. Reaching out early increases your options.

- Secure key documents offline: Save digital copies of tax records, pay stubs, loan documents, permits, and ID scans in a secure location in case you temporarily lose access to some online federal systems.

- Clarify your formal status: If you work for or with the federal government, confirm with HR or your contracting officer whether you would be considered “excepted,” furloughed, or delayed in the event of another shutdown, and what that would mean for your pay.

What businesses should monitor and do now

Companies that contract with the federal government, cater to federal workers, or depend heavily on permitting and regulatory approvals should:

- Map out exposure: Identify which revenue streams hinge on federal operations, grants, or approvals, and estimate how long you could sustain a pause.

- Diversify timelines and clients where possible: Stagger contract start dates and cultivate non-federal customers to limit the impact of any single funding lapse.

- Negotiate flexible contract terms: When feasible, include provisions that allow schedule adjustments or revised milestones if government operations are suspended.

- Plan for staffing decisions: Decide in advance how you’ll handle reduced hours, temporary reassignments, or remote work if key projects halt.

A quick guide to tracking risk and taking action:

| Risk Area | What to Watch | Protective Strategy |

|---|---|---|

| Paychecks | Agency contingency plans, OPM notices, and union updates. | Build savings to cover 1-2 pay periods; understand how your role is classified. |

| Benefits | Official communications from SSA, USDA, HHS, and state agencies. | Schedule major purchases or financial commitments away from known funding deadlines. |

| Contracts | Appropriations status, award dates, and contract option timelines. | Negotiate flexible deliverables and maintain a cash cushion for delayed invoices. |

| Travel & Licensing | Processing times and backlogs at TSA, FAA, State Department, and other regulators. | Apply early for passports, renew licenses or certifications ahead of expiration dates. |

Insights and Conclusions

As federal departments and agencies return to normal hours and restart suspended work, the long tail of this record-breaking shutdown is only beginning to emerge. Backlogged applications, delayed inspections, postponed research projects, and strained household finances will take months-if not longer-to unwind. Many communities will continue to feel the effects in the form of slower services, cautious consumer spending, and uncertainty about future federal reliability.

Politically, the shutdown exposed just how vulnerable core public services are to partisan deadlock. It highlighted the limits of stopgap funding and underscored the personal and economic costs of using shutdowns as leverage in policy fights. For federal workers and contractors, it reinforced the need for individual contingency planning. For lawmakers, it raised difficult questions about how to prevent essential government functions from being repeatedly pulled into high-stakes standoffs.

While the immediate crisis has ended, the structural issues that made this shutdown possible-and prolonged it-remain. How Congress and the White House handle upcoming funding deadlines will determine whether this was an outlier or a preview of future battles. In the meantime, households, businesses, and communities that depend on a stable federal government are increasingly building their own safeguards against the next impasse.