Understanding Business Failure Rates and How to Boost Startup Success

Analyzing the Rate of Business Failures Within the First Year

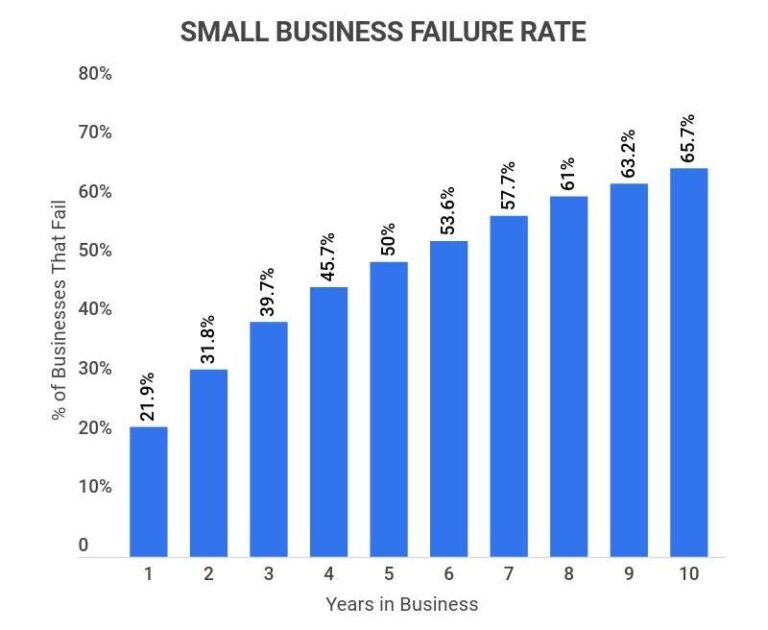

Launching a new enterprise is an exhilarating yet risky endeavor. Research consistently indicates that nearly one in five startupsŌĆöabout 20%ŌĆöcease operations within their inaugural year. This high attrition rate often stems from challenges such as inadequate funding, insufficient market insight, and flawed strategic planning. Entrepreneurs frequently misjudge operational expenses or overproject customer interest, resulting in cash shortages that can quickly undermine their ventures.

Identifying the primary reasons behind these early closures provides valuable lessons for new business owners. Common stumbling blocks include:

- Unclear or weak value propositions

- Poor financial oversight

- Inability to pivot with market trends

- Underestimating competitive pressures

- Neglecting effective marketing strategies

| Cause | Contribution to Failure | Recommended Approach |

|---|---|---|

| Insufficient Funding | 35% | Detailed budgeting and contingency reserves |

| Inadequate Market Analysis | 25% | Comprehensive competitor and customer research |

| Leadership and Management Deficiencies | 20% | Ongoing leadership development and mentorship |

| Marketing Shortcomings | 15% | Targeted, adaptable marketing campaigns |

Primary Drivers Behind Elevated Business Failure Rates

Many startups falter due to a combination of avoidable errors. Among these, financial mismanagement is a predominant factor, with many businesses underestimating startup costs or overestimating early income. Additionally, insufficient market research leaves companies vulnerable to launching products or services that do not align with consumer needs. Operational inefficiencies, such as poor supply chain management or a weak digital footprint, further compound these issues, especially in todayŌĆÖs rapidly evolving online marketplace.

Additional factors contributing to failure include:

- Deficient business planning that limits adaptability to shifting market dynamics.

- Weak leadership that hampers decision-making and team cohesion.

- Cash flow mismanagement leading to operational disruptions and missed growth opportunities.

- Ignoring customer feedback, resulting in diminished loyalty and negative brand perception.

| Issue | Severity | Typical Remedy |

|---|---|---|

| Financial Mismanagement | High | Regular financial audits and budgeting |

| Insufficient Market Research | Medium | In-depth competitor and customer analysis |

| Leadership Gaps | Medium | Leadership coaching and team development |

| Cash Flow Challenges | High | Implementing cash flow monitoring systems |

Effective Approaches to Enhance Startup Longevity

To increase the likelihood of long-term success, entrepreneurs should emphasize strategic foresight and adaptability. Gaining a deep understanding of market needs, coupled with ongoing customer engagement, enables businesses to refine their offerings and avoid costly errors. Establishing a solid financial foundation, including emergency funds, equips startups to weather economic uncertainties and maintain operational agility.

Building a supportive network of mentors and industry peers is equally vital. Such relationships provide accountability, fresh insights, and collaborative opportunities that can propel a business forward. Below is a summary of key survival tactics and their anticipated benefits:

| Tactic | Expected Outcome |

|---|---|

| In-Depth Market Research | Enhanced alignment with customer needs |

| Robust Financial Oversight | Improved cash flow and resource allocation |

| Networking and Mentorship | Access to expert advice and strategic partnerships |

| Agile Business Practices | Rapid adaptation to evolving market conditions |

- Continuously reassess business objectives and pivot strategies to maintain relevance.

- Commit to ongoing education to sharpen skills and industry knowledge.

- Focus on delivering exceptional customer experiences to boost loyalty and generate referrals.

Financial Stewardship and Market Responsiveness: Expert Recommendations

Sound financial management is a cornerstone of enduring business success. Industry experts advise maintaining healthy cash flow and regularly tracking financial indicators such as liquidity ratios and debt levels to avoid common pitfalls. Employing flexible budgeting techniques allows companies to reallocate resources swiftly in response to market shifts. Many thriving businesses utilize financial software to automate tracking, minimize errors, and enable real-time decision-making. Additionally, diversifying income sources can provide a buffer against market volatility, enhancing overall resilience.

Adapting to market changes demands both anticipation and nimbleness. Leading companies frequently perform competitive benchmarking and solicit customer feedback to identify emerging trends and adjust their strategies accordingly. The table below outlines key adaptation methods and their benefits for business sustainability:

| Adaptation Strategy | Advantage |

|---|---|

| Ongoing Market Intelligence | Early detection of new opportunities |

| Flexible Product Development | Quick alignment with customer preferences |

| Dynamic Pricing Strategies | Enhanced competitiveness during economic fluctuations |

| Strong Supplier Partnerships | Reliable supply chain and operational continuity |

Final Thoughts: Turning Challenges into Opportunities

In todayŌĆÖs fiercely competitive business environment, grasping the realities behind startup failure rates is essential for entrepreneurs and investors alike. LendingTreeŌĆÖs recent findings highlight that a substantial portion of new ventures do not endure beyond their early years, emphasizing the necessity of strategic foresight, prudent financial management, and adaptability. By leveraging expert advice, utilizing available resources, and maintaining realistic expectations, business owners can significantly enhance their chances of success. Staying proactive and informed is key to transforming obstacles into growth opportunities in an ever-changing marketplace.