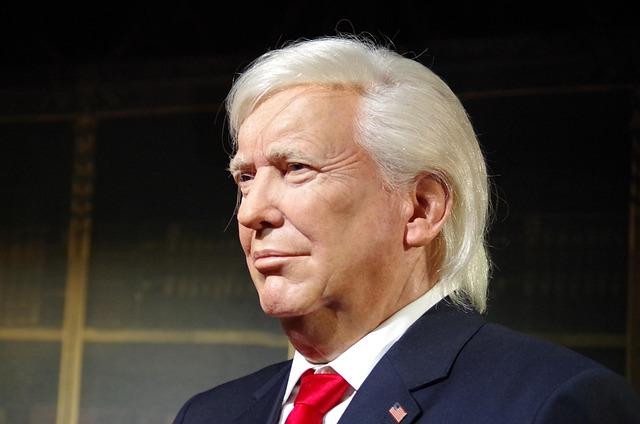

As Donald Trump renews calls for broad-based tariffs on imported goods, corporate America is already repositioning. From groceries to gadgets, major brands are quietly signaling that if sweeping import duties move ahead, shoppers should expect to pay more. The possibility of tariffs that go far beyond those from TrumpŌĆÖs first term has prompted executives, boards, and investors to run the numbers on how quickly, and how fully, higher costs can be pushed onto consumers. Those decisions will influence the next chapter of U.S. inflation, shape household spending, and determine much of the political fallout from a trade offensive that Trump and his allies are promoting as a core pillar of his economic strategy.

Boardrooms prepare for Trump tariffs with new pricing playbooks

Across corporate headquarters and distribution centers, pricing strategies are being rewritten to anticipate higher tariffs. Consumer brands, carmakers, and industrial giants are now modeling new cost structures that assume steeper import duties on everything from semiconductor chips to rolled steel. The early conclusion in many sectors: consumers will shoulder a significant share of the hit.

National retailers are drafting contingency price sheets that can be deployed within days if tariffs take effect, while manufacturers are rewriting supplier contracts to include tariff pass-through clauses, automatic surcharges, and faster price-adjustment triggers. Finance, procurement, and sales teams are integrating live data into dynamic pricing tools, stress-testing multiple scenarios that account for different tariff rates, exchange-rate swings, and shifts in consumer demand.

Executives describe a layered response designed to protect margins without sparking immediate sticker shock. Among the tactics under consideration:

- SKU-by-SKU increases on imported or tariff-exposed products, while keeping headline prices steady on domestic bestsellers.

- Shrinkflation strategies, such as reducing package sizes or features rather than visibly raising shelf prices.

- Scaling back promotions and coupons, effectively lifting average selling prices without major list-price jumps.

- Reshoring and nearshoring segments of the supply chain over the medium term to curb long-run tariff exposure.

| Sector | Planned Move | Expected Price Impact |

|---|---|---|

| Consumer Electronics | Targeted surcharges on imports | 3ŌĆō7% |

| Apparel & Footwear | Fewer discounts, smaller pack sizes | 2ŌĆō5% |

| Automotive | Tariff-linked fees on higher-end models | 4ŌĆō8% |

| Industrial Goods | Contractual tariff pass-through provisions | 5ŌĆō10% |

This kind of forward planning reflects lessons from the 2018ŌĆō2019 tariff rounds and the pandemic era: once pricing algorithms and contracts are adjusted, the new cost structure can persist long after the initial shock has passed.

Tariffs strain global supply chains from factory floor to store shelf

In plants, warehouses, and ports across the U.S., the threat of higher import duties is already reverberating through supply chains. Agreements that were negotiated months, or even years, ago are being reopened, freight forwarders are inserting new tariff surcharges, and smaller vendors are demanding stricter payment terms to cover rising customs and compliance costs.

Retailers and manufacturers are also scouting alternative sourcing hubs. Shifting production from long-standing suppliers in China and Southeast Asia to emerging bases in Mexico, Brazil, or Eastern Europe, however, involves new legal, logistical, and quality-control hurdles. The transition is slow and expensive, creating mismatches in inventory: some parts arrive earlier than forecast, while others are delayed, leaving companies overstocked in one category and facing empty shelves in another.

Logistics managers emphasize that these disruptions go beyond big-ticket consumer items. Everyday productsŌĆöfrom refrigerators and microwaves to backpacks and notebooksŌĆödepend on international supply chains now being reconfigured. To hedge against this volatility, many businesses are leaning into dual-sourcing strategies, securing backup suppliers in multiple regions and revising shipping routes to avoid bottlenecks. That added complexity raises administrative and transportation costs long before imported goods clear customs.

In response, firms are also experimenting with smaller, more frequent orders instead of large, infrequent shipments to reduce the financial risk tied to any single tariff decision. Industry analysts caution that once these new patterns are codified in contracts and logistics systems, they could redefine ŌĆ£normalŌĆØ in global trade, even if political rhetoric cools.

- Lead times are lengthening as more cargo is pulled aside for inspections, tariff classification checks, and documentation reviews.

- Safety stocks and inventory buffers are expanding, tying up working capital and increasing warehousing requirements.

- Supplier diversification is intensifying, but onboarding and quality validation for new partners push up short-term costs.

- Freight agreements increasingly feature flexible tariff pass-through provisions, shifting risk further down the chain.

| Sector | Typical Delay | Cost Impact |

|---|---|---|

| Automotive parts | +10ŌĆō15 days | +5ŌĆō8% per unit |

| Consumer electronics | +7ŌĆō12 days | +6ŌĆō10% per device |

| Apparel & footwear | +5ŌĆō9 days | +4ŌĆō7% per item |

These delays and cost additions come on top of structural shifts that have already reshaped shipping since 2020, including periodic port congestion, labor disputes, and geopolitical flashpoints that affect key trade routes.

Shoppers face a slow burn of tariff-driven price increases

For U.S. households, the tangible impact of new tariffs will show up not in legal texts, but at checkout. Supermarkets, e-commerce platforms, and big-box stores are recalibrating their pricing models to reflect potential duty hikes on imported finished goods and key components alike. Rather than absorb the full blow, most companies plan a gradual roll-out of higher prices.

Internal forecasts at major retailers point to step-by-step increases meant to probe how much consumers will tolerate. Categories that rely heavily on foreign inputs or final assemblyŌĆösuch as electronics, appliances, and many home goodsŌĆöare particularly exposed. Even relatively small percentage hikes, when applied across weekly purchases, can materially squeeze budgets that are already under pressure from housing, healthcare, and childcare costs.

This environment may accelerate the tilt toward private-label and value brands, as shoppers trade down from premium labels to stretch their paychecks. According to recent consumer surveys, price sensitivity remains elevated, with many households reporting they now comparison-shop across multiple stores and apps before making routine purchases.

Behind the scenes, corporate pricing teams are revising their approaches to manage both margin protection and reputational risk. Common strategies under review include:

- Tiered price hikes that raise costs faster on flagship or premium offerings while keeping entry-level items more affordable.

- Smaller packages or fewer features to hide effective unit-price increases while keeping nominal price points familiar.

- Rebalancing sourcing networks by mixing tariff-affected imports with lower-cost domestic or regional alternatives.

- Carefully timed promotions that soften the blow when new prices go live, especially around key shopping seasons.

| Category | Estimated Price Rise | Timing Signal |

|---|---|---|

| Groceries | 2ŌĆō4% | Within 1ŌĆō2 quarters |

| Electronics | 5ŌĆō8% | Before holiday season |

| Home goods | 3ŌĆō6% | As new inventory cycles in |

While headline inflation has eased from its pandemic-era peaks, economists warn that a fresh round of trade barriers would add a new layer of price pressure, especially if companies use the policy shift as an opportunity to rebuild margins compressed over the past several years.

Business groups seek clarity on tariff rules and safeguards

Policy uncertainty now rivals the tariff rates themselves as a top concern in corporate circles. Trade associations, chambers of commerce, and multinational firms are lobbying Washington for detailed, product-level guidance on any future tariff schedule. Without clear rules, businesses fear a maze of conflicting interpretations from different ports and agencies, increasing compliance risks and legal exposure.

Industry coalitions are pushing for a framework that includes clear exemption criteria, predictable phase-in timelines, and standardized appeals and review processes. Executives say they need a transparent roadmap that distinguishes short-term, politically driven surcharges from long-term structural shifts in U.S. trade policy. In their view, clarity on duration and scope matters nearly as much as the percentage rate on any given import.

- SectorŌĆæspecific carveŌĆæouts for critical goods such as medical supplies, certain food products, and high-tech inputs.

- PhaseŌĆæin periods that line up with existing contracts, giving firms time to renegotiate and adjust sourcing.

- Uniform customs guidance so importers face consistent rules and documentation demands across all ports of entry.

- DataŌĆædriven reviews that allow tariff levels to be revisited if inflation or economic stress exceeds thresholds.

| Industry | Key Safeguard Sought | Main Concern |

|---|---|---|

| Retail | Advance tariff calendars | Pricing strategy and seasonal inventory planning |

| Automotive | Component exemptions | Imported parts costs and model profitability |

| Technology | Clear origin rules | Complex, multi-country production chains |

| Manufacturing | Accessible appeal mechanisms | Margin erosion on long-term, fixed-price contracts |

Economists note that vague timelines and shifting policy signals are already prompting businesses to build preemptive price increases into their models and to stockpile key components where feasible. These defensive moves can intensify the inflationary impact of tariffs, even before new rates formally take effect.

Corporate legal and compliance teams are calling for more granular tariff classifications, explicit safe harbors for small and mid-size importers, and coordinated communication from the White House, the U.S. Trade Representative, and Customs and Border Protection. In the absence of such assurances, many firms are defaulting to worst-case scenarios in their planningŌĆöeffectively passing on anticipated costs to customers before the ink is dry on any final policy.

The Way Forward

As the likelihood of sweeping tariffs looms, the real test of this policy shift will take place at the register, not in press conferences. The choices businesses makeŌĆöwhether to absorb, offset, or fully pass on higher import costsŌĆöwill determine how deeply tariffs cut into household budgets and how much they reshape the broader inflation picture.

Policymakers face a narrowing window to clarify their plans, calibrate safeguards, and mitigate unintended consequences across supply chains. Meanwhile, companies in nearly every sector are signaling that if tariffs are implemented, they will share the burden with consumers rather than bear it alone.

The next phase of the tariff debate will unfold not just in Washington, but across distribution centers, storefronts, and kitchen tables, where families and firms will navigate the concrete costs of a new chapter in U.S. trade policy.