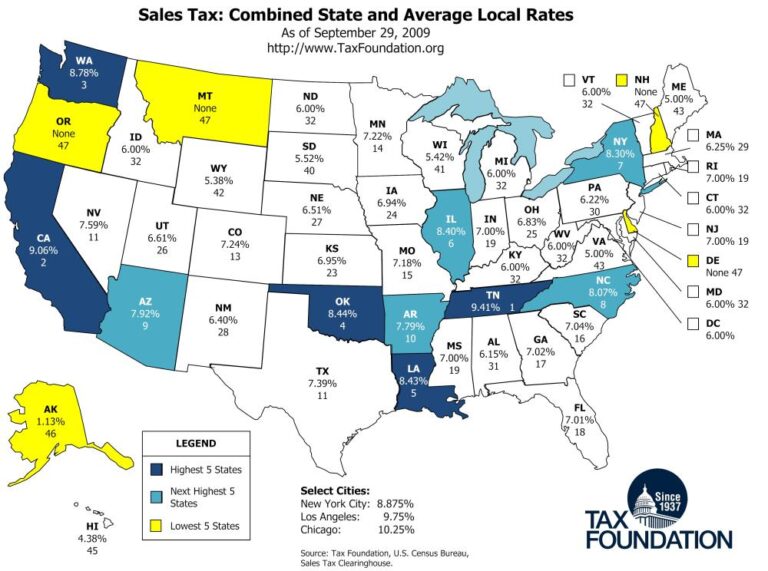

Washington State’s Comprehensive Tax Reforms: What Businesses and Individuals Need to Know

In response to escalating budgetary pressures, Washington state has introduced a wide-ranging package of tax increases designed to enhance revenue streams. This marks one of the most substantial tax policy overhauls in recent years, targeting multiple sectors and income levels. As state officials strive to close funding gaps in essential public services while managing the complexities of economic recovery, these reforms carry significant consequences for residents and enterprises alike. This article delves into the specifics of the new tax laws, their projected effects, and the broader fiscal ramifications for Washington’s economy.

Major Tax Adjustments Affecting Washington’s Economy

During the latest legislative session, Washington enacted several pivotal tax changes that reshape the financial obligations of both corporations and individual taxpayers. Among the most notable are hikes in the corporate excise tax, the introduction of a capital gains tax, and an additional surcharge on high personal incomes. Lawmakers argue these measures are critical to sustaining public programs and addressing budget deficits amid uncertain economic conditions. Conversely, business leaders warn that these tax increases could hinder investment and economic expansion within the state.

The revised tax structure employs a tiered system, impacting various income groups and industries differently. Small and medium-sized businesses, in particular, may experience shifts in their tax liabilities, potentially affecting operational costs. Below is a concise overview of the key tax changes:

- Corporate Excise Tax: Raised from 1.5% to 2.2% on net income exceeding $500,000

- Capital Gains Tax: A 7% tax on annual capital gains above $250,000

- Personal Income Tax Surcharge: An extra 0.5% on incomes surpassing $1 million

| Tax Type | Previous Rate | Current Rate | Income Threshold |

|---|---|---|---|

| Corporate Excise Tax | 1.5% | 2.2% | $500,000+ |

| Capital Gains Tax | 0% | 7% | $250,000+ |

| Personal Income Tax Surcharge | 0% | 0.5% | $1 million+ |

In-Depth Review of Tax Policy Changes and Their Economic Consequences

Washington’s new tax legislation broadens the tax base by targeting higher earners and large corporations while attempting to shield the middle class through adjusted exemptions. Notably, the law also introduces taxes on digital goods and services, reflecting the state’s recognition of the growing digital economy’s role. These reforms aim to generate additional revenue to support public infrastructure, education, and social welfare programs.

Economic repercussions of these reforms are expected to be complex. High-income individuals may experience a reduction in disposable income, potentially curbing luxury spending and speculative investments. Meanwhile, businesses face increased operational costs due to higher occupational and excise taxes, which could influence hiring and expansion decisions. However, proponents emphasize that the increased revenue will strengthen the state’s fiscal health and fund critical services.

- Boost in state revenue to finance public projects and social programs

- Possible slowdown in investment and discretionary spending among affluent taxpayers

- Business adaptations to manage increased tax burdens

- Growth opportunities for digital service providers benefiting from updated tax codes

| Tax Measure | Projected Revenue Gain | Primary Affected Group | Economic Impact |

|---|---|---|---|

| Personal Income Tax Brackets | $450 million | High-income earners | Lower disposable income |

| Capital Gains Tax | $300 million | Investors | Reduced speculative trading |

| Business & Occupational Tax | $275 million | Corporations | Higher operational expenses |

| Digital Goods Tax | $100 million | Technology consumers | Expanded tax base |

Guidance for Businesses: Ensuring Compliance and Reducing Tax Exposure

Companies operating within Washington must adopt a forward-thinking approach to align their financial and operational systems with the new tax environment. Conducting thorough reviews of current tax practices is essential to uncover vulnerabilities and optimize compliance. Partnering with tax experts familiar with Washington’s evolving regulations can provide strategic advantages, helping businesses implement effective tax planning and avoid penalties. Staying informed through continuous monitoring of legislative updates is critical for timely adjustments.

To minimize risks, organizations should consider these best practices:

- Comprehensive training programs for finance and management teams to ensure awareness of tax obligations.

- Utilization of sophisticated tax software that can handle complex state tax rules and calculations.

- Robust documentation systems to maintain transparent records and facilitate audits.

- Regular consultations with legal advisors to clarify interpretations of tax laws and their operational impact.

| Compliance Approach | Key Advantage | Risk Addressed |

|---|---|---|

| Continuous Regulatory Monitoring | Prompt adaptation to changes | Avoidance of compliance penalties |

| Automated Tax Calculation Tools | Enhanced accuracy | Minimization of calculation errors |

| Legal Advisory Engagements | Clear understanding of tax laws | Resolution of interpretation issues |

Adaptive Financial Strategies for Businesses Amid Tax Changes

To counterbalance the effects of Washington’s expanded tax obligations, businesses must implement agile financial management practices. Prioritizing cash flow oversight and cost reduction will be vital. Organizations should reassess budgets to forecast the impact of increased taxes on expenses and profitability. Employing real-time financial analytics tools can empower companies to make swift, informed decisions regarding investments and expenditures.

Recommended approaches include:

- Postponing non-critical capital projects to conserve resources.

- Negotiating supply chain contracts to improve cost efficiency.

- Maximizing use of available tax credits and incentives offered by the state.

- Developing scenario-based financial plans to prepare for future fiscal shifts.

Additionally, businesses should consider strategic pricing adjustments based on market sensitivity analyses to maintain competitiveness without significantly reducing demand. Early collaboration with tax advisors will be crucial to navigate the complex tax landscape and enhance financial resilience.

| Strategy | Anticipated Benefit |

|---|---|

| Cash Flow Monitoring | Better liquidity control |

| Cost Management | Lower operational expenses |

| Utilization of Tax Incentives | Reduced effective tax burden |

| Scenario Planning | Enhanced risk preparedness |

Conclusion: Navigating Washington’s New Tax Environment

As Washington state advances with its comprehensive tax reforms, the full impact on businesses and residents will unfold over time. Stakeholders must remain vigilant and adaptable to the shifting regulatory framework to safeguard their financial interests. Continuous analysis and expert guidance will be indispensable in managing the challenges and opportunities presented by these significant fiscal changes. RSM US remains committed to delivering up-to-date insights to support effective decision-making in this evolving landscape.