Unraveling the Economic Struggles of America’s Most Challenged Generations

A recent in-depth investigation by The Washington Post sheds light on the multifaceted economic and social hardships confronting Millennials and Generation Z, often dubbed the most disadvantaged cohorts in U.S. history. This exploration reveals how stagnant income growth, mounting student debt, a volatile housing market, and unprecedented economic upheavals have collectively fostered a pervasive sense of financial instability and shrinking prospects. As experts and policymakers seek solutions, the report prompts urgent reflection on the long-term consequences for the country’s socioeconomic fabric.

Financial Hurdles Defining the Modern Young Adult Experience

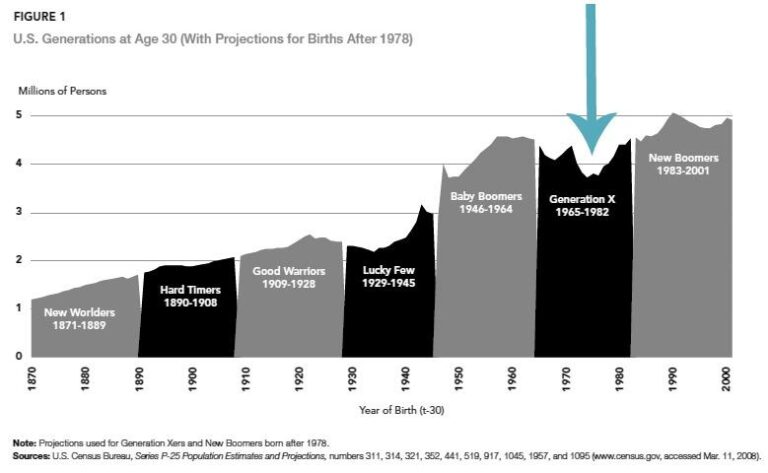

Over the past few decades, younger Americans have faced relentless economic headwinds that have reshaped their financial realities. Unlike Baby Boomers, who witnessed steady wage increases and accessible homeownership, today’s youth grapple with stagnant earnings, ballooning educational debt, and soaring living costs. The compounded effects of the 2008 recession and the COVID-19 pandemic have intensified these challenges, leaving many without stable employment or affordable healthcare options. Despite various government initiatives aimed at economic recovery, the gap between opportunity and actual financial security continues to widen.

Several critical elements contribute to this ongoing instability:

- Transformation of the workforce: The rise of automation and gig-based roles often means less job security and fewer traditional benefits.

- Housing market pressures: Rapidly increasing rents and home prices place ownership beyond the reach of many young adults.

- Student loan obligations: The burden of repaying education loans competes directly with the ability to save or invest.

| Economic Metric | Effect on Millennials & Gen Z | Baby Boomers’ Experience |

|---|---|---|

| Median Household Income | Flat since 2000 | Grew by approximately 40% |

| Homeownership Rate | 45% in 2023 | 65% in 1980 |

| Average Student Debt | Nearly $38,000 | Less than $10,000 in 1980 |

The Housing Affordability Crisis: A Barrier to Wealth Building

The scarcity of affordable housing has become a significant obstacle for younger generations aiming to secure financial stability. Unlike previous eras where home prices and mortgage rates were more manageable, today’s prospective buyers face property values that often outpace wage increases. This imbalance disrupts the traditional route to wealth accumulation, which has historically hinged on homeownership as a cornerstone of economic security.

Factors intensifying the housing crunch include:

- Restrictive zoning laws and delays in new construction limiting supply

- Rising costs of building materials and labor due to inflation

- Higher interest rates making mortgages less affordable

- Investor activity inflating prices in major urban centers

| Generation | Median Home Price (1980s) | Median Home Price (2020s) | Homeownership Rate |

|---|---|---|---|

| Baby Boomers | $75,000 | $290,000 | 72% |

| Generation X | $120,000 | $350,000 | 67% |

| Millennials | $230,000 | $430,000 | 52% |

The repercussions extend beyond real estate, affecting broader economic mobility. With fewer young adults able to purchase homes, the traditional mechanism for building and transferring wealth is constricted, exacerbating income inequality and threatening to transform the American dream into an increasingly unattainable goal.

Shifting Employment Landscape and the Quest for Stability

The U.S. labor market is undergoing rapid evolution driven by technological innovation and global economic trends. Many industries that once offered lifelong careers now rely heavily on contract work, automation, and outsourcing, leaving workers vulnerable to job insecurity. This shift has resulted in stagnant wages, erratic work schedules, and diminished benefits, disproportionately impacting younger workers and widening generational economic disparities.

Key contributors to job market instability include:

- Automation displacing routine and mid-level jobs faster than new roles are created

- Expansion of gig economy jobs that provide flexibility but lack traditional protections

- Corporate focus on maximizing shareholder returns often at the expense of employee job security

- Mismatch between educational training and evolving labor market demands

| Period | Estimated Job Losses (millions) | Main Cause |

|---|---|---|

| 2000‚Äď2010 | 4.5 | Offshoring and Automation |

| 2010‚Äď2020 | 3.2 | Rise of Contract Employment |

| 2020‚Äď2024 | 2.8 | Growth of Gig Economy |

Strategic Policy Interventions to Alleviate Economic Strain

Confronting the deep-rooted economic difficulties faced by younger Americans demands comprehensive policy reforms centered on enhancing affordability and expanding opportunities. Increasing funding for affordable housing projects and reforming zoning laws can help reduce the burden of high rents. Reforming student loan programs by lowering interest rates and broadening forgiveness options would relieve financial pressure, enabling more savings and investment. Additionally, targeted tax incentives for young families and first-time homebuyers could provide immediate economic relief and encourage broader participation in the economy.

Structural reforms in labor and social policies are equally vital. Expanding workforce development initiatives tailored to emerging sectors can equip young workers with skills for better-paying jobs. Strengthening social safety nets, including broader Medicaid coverage and guaranteed paid family leave, can mitigate economic stress related to health and caregiving responsibilities. The following table outlines potential policy areas alongside their anticipated short-term benefits:

| Policy Focus | Projected Outcome | Estimated Implementation Period |

|---|---|---|

| Affordable Housing Programs | Reduce rent costs by 15% | 2 to 4 years |

| Expanded Student Loan Forgiveness | Lower debt burden by 20% | 1 to 3 years |

| Tax Relief for Young Families | Increase disposable income | Immediate |

| Workforce Training Initiatives | Boost employment in higher-wage sectors | 3 to 5 years |

Final Thoughts

The Washington Post’s analysis underscores the significant economic and social obstacles confronting Millennials and Generation Z, often regarded as America’s most economically challenged generations. From stagnant wages and overwhelming debt to disrupted career paths, the evidence calls for urgent policy action to reverse these trends. Addressing the systemic roots of these challenges is essential to restoring economic opportunity and security, ensuring that future generations can achieve financial stability and the promise of the American dream.