Resumption of Federal Student Loan Collections Under Trump Administration

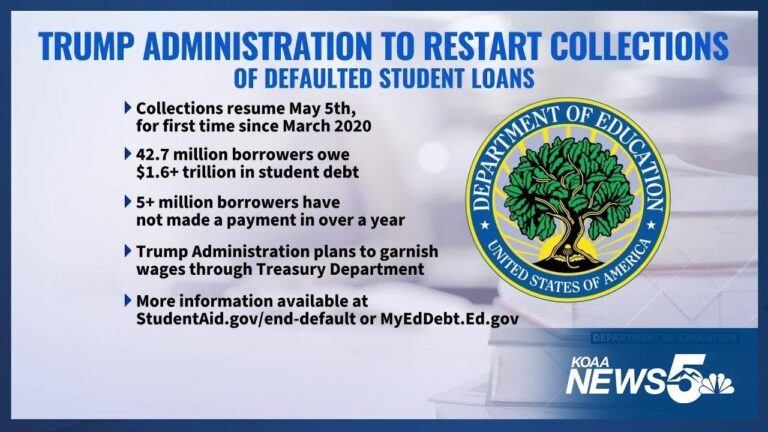

Following a suspension during the COVID-19 crisis, the Trump administration has announced the reinstatement of collection activities on federal student loans that have fallen into default. This policy reversal means that mechanisms such as wage garnishments, tax refund offsets, and other debt recovery procedures will recommence to reclaim billions in overdue payments. The Department of Education has warned borrowers in default to anticipate an increase in collection efforts, which could intensify financial hardships for those already under economic stress.

Key components of this policy shift include:

- Immediate reactivation of automatic payroll deductions

- Renewed interception of tax refunds to recover outstanding loan balances

- Enhanced borrower notifications from loan servicers regarding impending collection actions

| Collection Method | Effect on Borrower | Current Status |

|---|---|---|

| Wage Garnishment | Reduction in net income | Reinstated |

| Tax Refund Offset | Seizure of tax refunds | Resumed |

| Credit Reporting | Negative impact on credit score | Ongoing |

Effects on Borrowers Who Defaulted During the Pandemic Relief Period

The conclusion of pandemic-related relief programs presents a critical challenge for borrowers who defaulted on their student loans during the moratorium. These individuals now face the reactivation of collection procedures, including wage garnishments, tax refund seizures, and potential loss of federal benefits. Many of these borrowers have already endured economic instability due to job losses and ongoing financial uncertainty. Experts caution that without targeted interventions, the renewed enforcement could deepen financial distress, especially among low-income populations and those lacking access to financial guidance.

Major obstacles confronting these borrowers include:

- Escalated debt levels caused by accrued interest and fees during the suspension

- Risk to creditworthiness which may hinder future borrowing and housing opportunities

- Heightened mental health strain as financial pressures persist amid economic recovery

To contextualize the scope, the table below summarizes estimated impacts on borrowers in default:

| Group | Approximate Number | Average Debt Increase | Potential Consequences |

|---|---|---|---|

| Borrowers in Default | Over 2 million | $3,200 | Wage Garnishment, Tax Refund Seizure |

| Low-Income Borrowers | Approximately 1.2 million | $1,800 | Loss of Eligibility for Public Assistance |

| First-Time Defaulters (During Pandemic) | About 750,000 | $2,500 | Credit Score Deterioration |

Complexities and Legal Framework of Student Loan Collections

Recovering debts from federal student loan defaulters involves navigating a labyrinth of challenges, including administrative obstacles and the precarious financial situations of borrowers. Many individuals defaulted due to unforeseen economic hardships, making aggressive collection tactics ethically questionable and often subject to legal challenges. Federal agencies must carefully balance the imperative to recover funds with protecting the rights of borrowers who may be facing genuine financial difficulties. Clear communication and transparency are essential, as misunderstandings about repayment terms and forgiveness programs frequently lead to disputes.

Legal protections significantly influence collection strategies. Federal laws such as the Fair Debt Collection Practices Act (FDCPA) impose strict guidelines on collection behavior, safeguarding borrowers from harassment and unfair practices. Borrowers retain the right to dispute debts and request validation, which can delay collection processes and increase administrative complexity. The table below outlines key legal considerations affecting debt recovery:

| Legal Provision | Effect on Debt Collection |

|---|---|

| Fair Debt Collection Practices Act (FDCPA) | Limits aggressive collection methods and enforces borrower protections |

| Borrower Dispute Rights | Enables challenges to debt validity, potentially delaying recovery |

| Income-Driven Repayment Plans | Offers alternatives that reduce default risk but complicate collections |

| Statute of Limitations | Restricts the timeframe for legal debt collection actions |

- Regulatory supervision ensures equitable treatment of borrowers.

- Litigation risks may arise if borrowers allege abusive collection practices.

- Data privacy must be rigorously maintained throughout collection efforts.

Practical Advice for Borrowers to Manage Repayment and Avoid Penalties

Borrowers confronting renewed collection activities under the Trump administration’s directive should engage proactively with their loan servicers to explore all repayment alternatives. Early communication can facilitate negotiations for reduced payments or alternative arrangements that may prevent wage garnishment or tax refund seizures. Enrolling in income-driven repayment plans or loan rehabilitation programs can help restore good standing and halt aggressive collection measures. Staying informed about eligibility and program options is vital to mitigating financial stress during this transition.

Recommended steps for borrowers include:

- Establish automatic payments to avoid missed deadlines and additional fees.

- Regularly review loan statements to verify accuracy and detect discrepancies.

- Consult nonprofit credit counseling services specializing in student loan debt management.

- Monitor credit reports to promptly address any adverse entries related to loan default.

| Repayment Approach | Expected Benefit |

|---|---|

| Loan Rehabilitation | Eliminates default status and improves credit history |

| Income-Driven Repayment | Adjusts monthly payments based on income |

| Deferment or Forbearance | Temporarily suspends payments during financial hardship |

| Automatic Payments | Prevents missed payments and late fees |

Conclusion

The Trump administration’s decision to restart collections on defaulted federal student loans signals a major policy shift following the pandemic relief period. This change is poised to place renewed financial pressure on millions of borrowers, many of whom are still recovering from economic setbacks. As this situation unfolds, borrowers, advocates, and policymakers will continue to scrutinize the impact on the broader student debt landscape and explore potential avenues for relief. Stay tuned for ongoing updates and guidance on navigating these developments.